|

|

Redeveloping an historic downtown theater? Advantages of public-private partnershipBy CED Guest AuthorPublished July 10, 2012

In order to get the project done, the town could develop the property strictly as a public project (as any town would build a community center or fire station). However, in this case, the Development Finance Initiative (DFI) advised the town to take a leadership role in the theater’s redevelopment and to bring in a private partner to help them, here’s why: Cost Savings/tax credits: If the building is historic it may qualify for historic tax credits that can provide significant financial resources for the improvements to the property. Local governments can not take advantage of these tax credits but with the involvement of a private partner the community could save up to 30% on the overall cost of the project. In this case, the potential savings exceeded $1,000,000. Risk avoidance: Fixing up historic properties can be difficult and can create additional project risks as you have to deal with unknown and sometimes hidden conditions. If the community owns the project, they also own the risk of finding conditions midstream that may require costly changes. A public/private partnership can be structured to ensure that this “construction risk” is assumed by the private partner. Better leveraging of community assets: Every community has limited resources to pursue community and economic development goals. When a town is figuring out how to deploy its resources for redevelopment, there are advantages and disadvantages to public property ownership. In this case, it was more advantageous for the town to sign a long-term lease for its community space than to own the property outright. Their “pre-lease” could attract multiple potential private partners creating a competitive environment and generating a better deal for the community. In addition, as a private property, this asset can generate revenue (property taxes). Creating Stakeholders: Probably the most important and often most overlooked benefit of bringing in a private partner to help revitalize a dilapidated property in a long forgotten part of town is the power of engagement. The more folks you can get invested in your community’s success, the more likely your community and economic development goals will be successful. |

Published July 10, 2012 By CED Guest Author

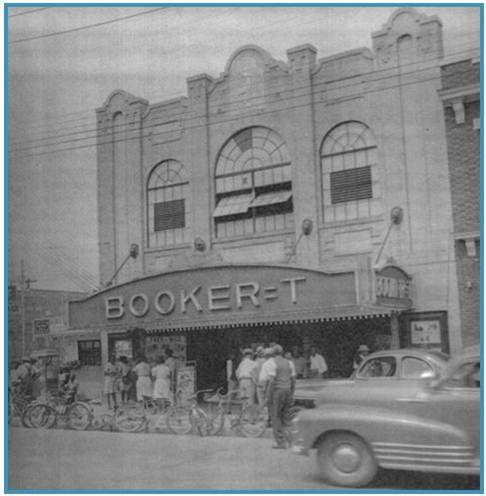

The historic theater on Main Street sat empty for thirty years. Once the central gathering place and crown jewel of Main Street, the property collected cobwebs as town leaders waited for a private developer to come along with a plan to bring the building back into productive use. Eventually, public officials and town staff grew tired of waiting and decided to take matters into their own hands. Several key leaders determined that there was demand for a community space in this once vibrant property, and that its redevelopment was an important priority.

The historic theater on Main Street sat empty for thirty years. Once the central gathering place and crown jewel of Main Street, the property collected cobwebs as town leaders waited for a private developer to come along with a plan to bring the building back into productive use. Eventually, public officials and town staff grew tired of waiting and decided to take matters into their own hands. Several key leaders determined that there was demand for a community space in this once vibrant property, and that its redevelopment was an important priority.

In order to get the project done, the town could develop the property strictly as a public project (as any town would build a community center or fire station). However, in this case, the Development Finance Initiative (DFI) advised the town to take a leadership role in the theater’s redevelopment and to bring in a private partner to help them, here’s why:

Cost Savings/tax credits: If the building is historic it may qualify for historic tax credits that can provide significant financial resources for the improvements to the property. Local governments can not take advantage of these tax credits but with the involvement of a private partner the community could save up to 30% on the overall cost of the project. In this case, the potential savings exceeded $1,000,000.

Risk avoidance: Fixing up historic properties can be difficult and can create additional project risks as you have to deal with unknown and sometimes hidden conditions. If the community owns the project, they also own the risk of finding conditions midstream that may require costly changes. A public/private partnership can be structured to ensure that this “construction risk” is assumed by the private partner.

Better leveraging of community assets: Every community has limited resources to pursue community and economic development goals. When a town is figuring out how to deploy its resources for redevelopment, there are advantages and disadvantages to public property ownership. In this case, it was more advantageous for the town to sign a long-term lease for its community space than to own the property outright. Their “pre-lease” could attract multiple potential private partners creating a competitive environment and generating a better deal for the community. In addition, as a private property, this asset can generate revenue (property taxes).

Creating Stakeholders: Probably the most important and often most overlooked benefit of bringing in a private partner to help revitalize a dilapidated property in a long forgotten part of town is the power of engagement. The more folks you can get invested in your community’s success, the more likely your community and economic development goals will be successful.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.