|

|

Student Corner: Easing the Federal Excise Tax on BrewersBy CED Program Interns & StudentsPublished April 2, 2015

Some have called it a beer movement, others a brewing renaissance, but regardless of how it’s described craft brewing is alive, well, and continuing to grow in the state of North Carolina. According to the North Carolina Brewer’s Guild, the Tar Heel State is currently home to over 100 breweries and brewpubs, with more opening every month, and over the past two years has become the destination-of-choice for larger scale, west coast craft brewers looking to establish east coast operations. Thanks to North Carolina’s brewer-friendly production and distribution regulations, Colorado-based Oskar Blues Brewery opened their east coast operations in Brevard, NC in 2013, earlier this month California-based Sierra Nevada opened doors to their east coast distribution facility in Mills River, NC, and by the end of 2015 Colorado-based New Belgium Brewery expects to open their Asheville brewing facility. Here in North Carolina and across the country craft brewing continues to contribute to job creation and economic growth. According to the Brewers Association, nation-wide in 2012 craft brewing contributed more than 360,000 jobs to the U.S. economy with North Carolina’s craft beer industry generating as much as $791 million in state-wide economic impact, with significant growth in the industry since. As the brewing renaissance continues here in North Carolina and across the United States, federal and state officials have increasingly recognized the value of American brewing and have proposed legislation relaxing federal taxes on the industry broadly. Two bills are currently before congress to reduce the federal excise tax on alcohol producers, a tax paid by the producer, imbedded in the price of a good, which consumers never see. Based on regulations set by the Tax and Trade Bureau (TTB) of the U.S. Department of Treasury, a “small brewer” is defined as one which produces less than 2 million barrels annually. Keeping with these guidelines the current federal excise tax, last revised in 1976, requires all brewers producing more than 2 million barrels annually pay an excise tax of $18 per barrel. Small brewers as defined by the TTB receive credits reducing their excise tax expense on the first 60,000 barrels to $7 per barrel. The two bills presently before Congress call for a reduction in the excise tax on brewers, each with a different approach and ultimate impact on industry players. Small Brewer Reinvestment and Expanding Workforce Act (Small BREW Act): Introduced by Reps. Erik Paulson, R-Minnesota, and Richard E. Neal, D-Massachusetts, as well as the four original bill co-sponsors, including North Carolina District 10 Republican Congressman Patrick McHenry, the Small BREW Act calls for a reduction in the current excise tax assessed on small brewers: Modifications to the federal excise tax under the Small BREW Act focus first on increasing the threshold below which producers are considered a “small brewer” from 2 million barrels annually to 6 million barrels annually, which supporters argue is more representative of the full craft brewing market here in the United States. Furthermore, the Small BREW Act only reduces excise taxes assessed on small brewers, making no adjustment to the current $18 per barrel tax that large brewers like Anheuser-Busch and Miller-Coors pay. The Brewers Association, a representative and advocate for over 3,200 small and independently owned craft beer brewers in the U.S., is a vocal proponent of the Small BREW Act noting that given size and scale, costs for small brewers are higher relative to larger producers and the bill’s excise tax reduction helps to level the playing field. Fair Brewers Excise and Economic Relief Act (Fair BEER Act): Introduced by Reps. Steve Womack R-Arkansas and Ron Kind, D-Wisconsin in 2015, the Fair BEER Act calls for a laddered approach to assessing excise tax on all beer producers and importers here in the United States, as follows: Through this revised scale small craft brewers receive a significant break; however, the proposed legislation also removes the existing “small craft brewer” threshold making all brewers, regardless of size, output and distribution, eligible for the relaxed tax scale. The Beer Institute, an advocate and representative of the American beer brewing industry broadly, including both craft brewers like Bell’s Brewery of Michigan, and large, multinational subsidiaries like Anheuser-Busch, is a vocal proponent of the BEER Act asserting that it provides a true leveled playing field across the industry. Regardless of where Congress lands on the excise tax debate, current proposals suggest positive changes for the brewing industry, which could further fuel ongoing growth in North Carolina and across the country. Tanner Dudley is a Master’s candidate in the Department of City and Regional Planning at UNC-Chapel Hill. He is also a Fellow with the Development Finance Initiative. |

Published April 2, 2015 By CED Program Interns & Students

Dueling bills have been introduced in Congress aimed at reducing the federal excise tax on brewers in an effort to support the industry.

Dueling bills have been introduced in Congress aimed at reducing the federal excise tax on brewers in an effort to support the industry.

Some have called it a beer movement, others a brewing renaissance, but regardless of how it’s described craft brewing is alive, well, and continuing to grow in the state of North Carolina. According to the North Carolina Brewer’s Guild, the Tar Heel State is currently home to over 100 breweries and brewpubs, with more opening every month, and over the past two years has become the destination-of-choice for larger scale, west coast craft brewers looking to establish east coast operations. Thanks to North Carolina’s brewer-friendly production and distribution regulations, Colorado-based Oskar Blues Brewery opened their east coast operations in Brevard, NC in 2013, earlier this month California-based Sierra Nevada opened doors to their east coast distribution facility in Mills River, NC, and by the end of 2015 Colorado-based New Belgium Brewery expects to open their Asheville brewing facility. Here in North Carolina and across the country craft brewing continues to contribute to job creation and economic growth. According to the Brewers Association, nation-wide in 2012 craft brewing contributed more than 360,000 jobs to the U.S. economy with North Carolina’s craft beer industry generating as much as $791 million in state-wide economic impact, with significant growth in the industry since.

As the brewing renaissance continues here in North Carolina and across the United States, federal and state officials have increasingly recognized the value of American brewing and have proposed legislation relaxing federal taxes on the industry broadly. Two bills are currently before congress to reduce the federal excise tax on alcohol producers, a tax paid by the producer, imbedded in the price of a good, which consumers never see. Based on regulations set by the Tax and Trade Bureau (TTB) of the U.S. Department of Treasury, a “small brewer” is defined as one which produces less than 2 million barrels annually. Keeping with these guidelines the current federal excise tax, last revised in 1976, requires all brewers producing more than 2 million barrels annually pay an excise tax of $18 per barrel. Small brewers as defined by the TTB receive credits reducing their excise tax expense on the first 60,000 barrels to $7 per barrel.

The two bills presently before Congress call for a reduction in the excise tax on brewers, each with a different approach and ultimate impact on industry players.

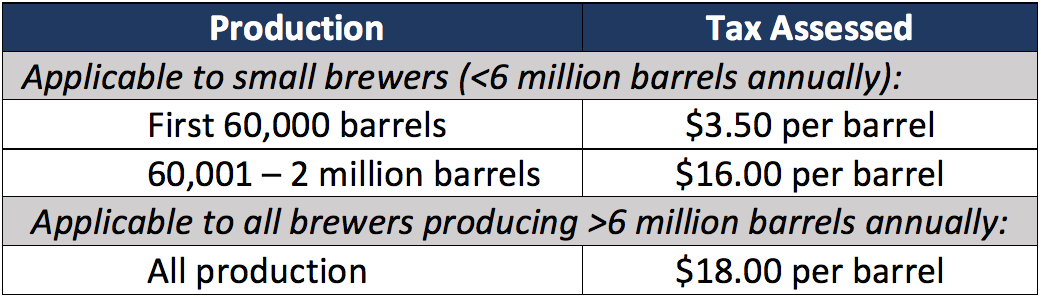

Small Brewer Reinvestment and Expanding Workforce Act (Small BREW Act): Introduced by Reps. Erik Paulson, R-Minnesota, and Richard E. Neal, D-Massachusetts, as well as the four original bill co-sponsors, including North Carolina District 10 Republican Congressman Patrick McHenry, the Small BREW Act calls for a reduction in the current excise tax assessed on small brewers:

Modifications to the federal excise tax under the Small BREW Act focus first on increasing the threshold below which producers are considered a “small brewer” from 2 million barrels annually to 6 million barrels annually, which supporters argue is more representative of the full craft brewing market here in the United States. Furthermore, the Small BREW Act only reduces excise taxes assessed on small brewers, making no adjustment to the current $18 per barrel tax that large brewers like Anheuser-Busch and Miller-Coors pay. The Brewers Association, a representative and advocate for over 3,200 small and independently owned craft beer brewers in the U.S., is a vocal proponent of the Small BREW Act noting that given size and scale, costs for small brewers are higher relative to larger producers and the bill’s excise tax reduction helps to level the playing field.

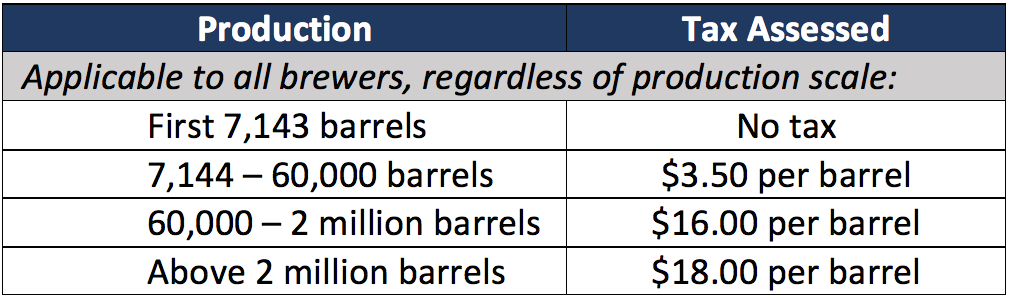

Fair Brewers Excise and Economic Relief Act (Fair BEER Act): Introduced by Reps. Steve Womack R-Arkansas and Ron Kind, D-Wisconsin in 2015, the Fair BEER Act calls for a laddered approach to assessing excise tax on all beer producers and importers here in the United States, as follows:

Through this revised scale small craft brewers receive a significant break; however, the proposed legislation also removes the existing “small craft brewer” threshold making all brewers, regardless of size, output and distribution, eligible for the relaxed tax scale. The Beer Institute, an advocate and representative of the American beer brewing industry broadly, including both craft brewers like Bell’s Brewery of Michigan, and large, multinational subsidiaries like Anheuser-Busch, is a vocal proponent of the BEER Act asserting that it provides a true leveled playing field across the industry.

Regardless of where Congress lands on the excise tax debate, current proposals suggest positive changes for the brewing industry, which could further fuel ongoing growth in North Carolina and across the country.

Tanner Dudley is a Master’s candidate in the Department of City and Regional Planning at UNC-Chapel Hill. He is also a Fellow with the Development Finance Initiative.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.