|

|

Student Corner: The Changing Dynamics of USDA’s Section 515 ProgramBy CED Program Interns & StudentsPublished December 14, 2018

In 1963, the USDA began the Section 515 Rural Rental Housing Loan Program to provide housing for very low, low, and moderate-income, elderly and disabled households in rural communities. The loans can apply to the purchase of land or buildings, costs associated with construction or renovation, and infrastructure to support rental housing development. According to a study released by the Housing Assistance Council (HAC) in September 2018, the program has provided financing for nearly 28,000 properties comprising 533,000 affordable units. Sec. 515 housing pairs with the USDA’s Section 521 Rural Rental Assistance program that provides a subsidy to low income households to allow them to afford rents in projects financed through the loan program. Among tenants of the Sec. 515 developments, two thirds of residents take advantage of the Sec. 521 Rental Assistance program. Financing for Sec. 515 developments have been provided by the USDA with 1% effective rate loans and 50-year amortization periods with 30-year terms. During the loan period, property owners must retain affordable rents (the greater of basic rent or 30% of the tenant’s adjusted income), but once mortgages are paid off, owners have the option to convert the property to other uses including market rate housing. As loans on Sec. 515 development properties have matured in recent years the number of affordable units in the program have begun to drop. This, paired with funding cuts leading to a lack of new developments, is placing further strain on the affordable housing market. According to HAC, between 2001 and 2016 loans were repaid on 1,564 properties resulting in the loss of 28,475 units from the program. Some owners of Sec. 515 properties are eligible to prepay mortgage payments to shorten the period of time the property must remain affordable. It is important to note that if the owner chooses to convert the property to market rate housing when the loan is paid off, tenants can no longer use Sec. 521 rental assistance subsidies, further straining tenants’ ability to afford rent payments. In North Carolina, there are 591 Sec. 515 properties containing over 21,000 units housing over 34,000 residents across 94 rural counties. Twenty-one percent of NC’s Section As properties leave the Sec. 515 program in the coming years, affordable housing advocates will need to redouble efforts to address the growing need for affordable housing for very low, low, and moderate-income, elderly and disabled households in rural communities across the state. Strategies have been drafted for retaining current projects, but retention is largely reliant on current owners choosing to refinance into the program. These strategies are further discussed in the recent HAC report. Bobby Funk is a Master’s candidate at UNC-Chapel Hill’s Department of City and Regional Planning and a Community Revitalization Fellow with the Development Finance Initiative. |

Published December 14, 2018 By CED Program Interns & Students

The United States Department of Agriculture (USDA) is the federal department primarily responsible for setting national food, farm, and nutrition policies across the country. In addition to management of national food systems, the USDA has played an important role in rural economic development. Managed by the the Office of Rural Development, the USDA administers grants, loans and loans guarantees for rural communities with a loan portfolio of over $222 billion.

The United States Department of Agriculture (USDA) is the federal department primarily responsible for setting national food, farm, and nutrition policies across the country. In addition to management of national food systems, the USDA has played an important role in rural economic development. Managed by the the Office of Rural Development, the USDA administers grants, loans and loans guarantees for rural communities with a loan portfolio of over $222 billion.

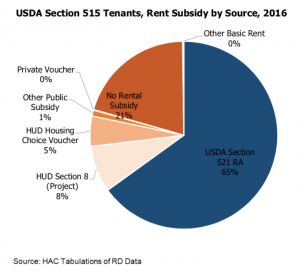

In 1963, the USDA began the Section 515 Rural Rental Housing Loan Program to provide housing for very low, low, and moderate-income, elderly and disabled households in rural communities. The loans can apply to the purchase of land or buildings, costs associated with construction or renovation, and infrastructure to support rental housing development. According to a study released by the Housing Assistance Council (HAC) in September 2018, the program has provided financing for nearly 28,000 properties comprising 533,000 affordable units. Sec. 515 housing pairs with the USDA’s Section 521 Rural Rental Assistance program that provides a subsidy to low income households to allow them to afford rents in projects financed through the loan program. Among tenants of the Sec. 515 developments, two thirds of residents take advantage of the Sec. 521 Rental Assistance program.

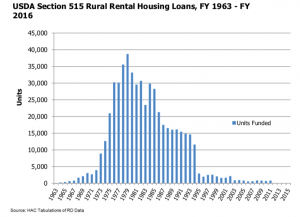

Financing for Sec. 515 developments have been provided by the USDA with 1% effective rate loans and 50-year amortization periods with 30-year terms. During the loan period, property owners must retain affordable rents (the greater of basic rent or 30% of the tenant’s adjusted income), but once mortgages are paid off, owners have the option to convert the property to other uses including market rate housing. As loans on Sec. 515 development properties have matured in recent years the number of affordable units in the program have begun to drop. This, paired with funding cuts leading to a lack of new developments, is placing further strain on the affordable housing market.

According to HAC, between 2001 and 2016 loans were repaid on 1,564 properties resulting in the loss of 28,475 units from the program. Some owners of Sec. 515 properties are eligible to prepay mortgage payments to shorten the period of time the property must remain affordable. It is important to note that if the owner chooses to convert the property to market rate housing when the loan is paid off, tenants can no longer use Sec. 521 rental assistance subsidies, further straining tenants’ ability to afford rent payments.

In North Carolina, there are 591 Sec. 515 properties containing over 21,000 units housing over 34,000 residents across 94 rural counties. Twenty-one percent of NC’s Section  515 developments took advantage of Low-Income Housing Tax Credits to help fund the development. The average age of NC’s 515 properties is 30 years old with the most recent development opening in 2016. Between 2018 and 2028, 23 properties are expected to leave the program resulting in the the loss of 875 affordable units, causing further strain on the affordable housing market in the state. Among Sec. 515 units in NC, 92% of reported units have some sort of rental assistance represented mostly by Sec. 521 Rental Assistance. Average income among NC’s Sec. 515 residents is $12,700, of which an average of 62% resident income is Social Security income.

515 developments took advantage of Low-Income Housing Tax Credits to help fund the development. The average age of NC’s 515 properties is 30 years old with the most recent development opening in 2016. Between 2018 and 2028, 23 properties are expected to leave the program resulting in the the loss of 875 affordable units, causing further strain on the affordable housing market in the state. Among Sec. 515 units in NC, 92% of reported units have some sort of rental assistance represented mostly by Sec. 521 Rental Assistance. Average income among NC’s Sec. 515 residents is $12,700, of which an average of 62% resident income is Social Security income.

As properties leave the Sec. 515 program in the coming years, affordable housing advocates will need to redouble efforts to address the growing need for affordable housing for very low, low, and moderate-income, elderly and disabled households in rural communities across the state. Strategies have been drafted for retaining current projects, but retention is largely reliant on current owners choosing to refinance into the program. These strategies are further discussed in the recent HAC report.

Bobby Funk is a Master’s candidate at UNC-Chapel Hill’s Department of City and Regional Planning and a Community Revitalization Fellow with the Development Finance Initiative.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.