|

|

Local Governments: Financial Feasibility Analysis for Your Revitalization ProjectsBy Tyler MulliganPublished June 12, 2019Do you have a revitalization project that is a local government priority? Did you know that local governments can obtain real estate development feasibility analysis by UNC graduate student teams at no charge? Since 2012, UNC faculty and staff associated with the Development Finance Initiative at the School of Government have worked with graduate student teams in a course on community revitalization to analyze revitalization projects for North Carolina communities at no charge. The School periodically requests project idea submissions from local government officials, and then students select their preferred projects. Student projects focus on attracting private sector investment for private (non-public) uses, such as converting a historic school into senior housing or a former fire station into a retail space (to understand what makes for an appealing student project and to submit a project online, click here). Over the course of a semester, students perform financial feasibility analysis to evaluate whether the private sector could accomplish the public’s revitalization goals, ranging from historic preservation to increasing downtown foot traffic after 5 pm. How is financial feasibility analysis useful to local governments, and how have local governments used student analysis in the past? The role of financial feasibility analysis for revitalization projects Revitalization projects are challenging. By definition, they typically involve neglected structures or underutilized land—hence the need for “revitalization.” The projects are often located in distressed or underperforming areas (usually characterized by blight, vacancy, and disinvestment), so the broader market is relatively weak. After all, if the market was strong, the private sector would have “revitalized” the project on its own. In these areas, there may have been little or no development activity for many years, making it difficult to convince lenders and investors that a project can work today. Unless the business case is obvious, private developers and investors won’t spend time identifying and researching projects in these distressed areas. In all of these instances, financial feasibility analysis can be helpful. It provides information to show whether or not a project is “feasible” in the sense that it could attract private investment. If a project can attract private investment, then local governments won’t have to spend their precious time and resources to revitalize the project. What is financial feasibility analysis? Financial feasibility analysis is an evaluation of project returns for a private development project. The analysis usually results in a financial model known as a pro forma. The pro forma includes a development budget, operating cash flows, and sources and uses of capital. It is designed to demonstrate expected returns with varying levels of debt, income, and expenses. The key to good financial feasibility, however, is careful analysis of the inputs to the pro forma. According to the academic literature, important inputs include the following:

In our graduate course in community revitalization, students spend much of the semester collecting and analyzing these inputs, culminating in a pro forma and financial feasibility report that summarizes the results of their analysis. Public officials are invited to attend students’ in-class presentations at the end of the semester. How is financial feasibility analysis used by a private developer? It is important to keep in mind that financial feasibility analysis does not make a development project happen. It merely shows whether or not development may be attractive to private developers and investors under certain assumed conditions. Executing the development project is another matter entirely. For example, even if financial feasibility analysis makes a developer optimistic that a particular development project could be attractive to private investors, that doesn’t mean investors will line up at the developer’s door. First, the developer must assemble a development team, to include general contractors, architects, engineers, and legal and accounting firms. The team will take a closer look at the project and refine the assumptions. Second, the developer must convince lenders and investors to provide capital at a reasonable cost (cost of capital includes the interest rate for loans and return expectations for equity investments). Potential lenders and investors will scrutinize the project and the development team to determine whether the team has a solid track record with the category of project (for example, a retail project should be attempted by a team with retail experience). Further, financial feasibility analysis makes important assumptions about development that are certain to change once the developer starts interacting with other members of the development team and financial decision-makers related to the project. The developer will be required to generate a more detailed (and almost always different) plan from the original feasibility analysis. It must be remembered that financial feasibility analysis is a research project—which is the reason it’s such a good fit for students and university experts—and as with all research projects, the conditions under which a project is executed in the field are certain to be different from the analysis performed in the lab. Is financial feasibility analysis useful even though assumptions may change? Even though assumptions such as rents, construction costs, and interest rates will change—sometimes significantly—from the original feasibility analysis, it is nonetheless very helpful to local governments. Just a few examples below show how local governments have used feasibility analysis by UNC graduate student teams. What can be done with the old jail site? Feasibility Analysis: The Town of Wilkesboro was unsure of the future of the county’s soon-to-be-demolished jail, located on a key intersection in downtown next to the local Heritage Museum. Analysis determined that office and residential uses were financially feasible and students presented their findings to Town officials in November 2015. The student team was later invited to present their findings to Town Council in 2016. A two-story project was shown to generate attractive returns, giving the local government an idea of what it could expect from developers with its plan to demolish the jail and sell the property. Shown below is the diagram produced by the student team to illustrate how a feasible project could fit on the site of the old jail.

Result: Local private developer Finley Properties Commercial Development exceeded expectations for the site by proposing a four-story building with 18 condominiums and a restaurant. Follow the link to a news article to compare the students’ plan above to the private developer’s architectural rendering. Attracting investor interest to downtown Feasibility Analysis: Students evaluated the redevelopment potential of an iconic downtown building in Graham and provided a financial feasibility report to City officials, including an examination of market conditions in downtown. Result: City officials circulated the report to downtown stakeholders and now give some credit to the student report for inspiring confidence in local investors, who began investing in development across downtown. The city planner found that “the analysis done by the Master’s students at UNC resulted in a product which private developers found accurate, thorough, and attainable.” The building analyzed by students also attracted investor interest and was sold at a price well above the expected price (article here). A microbrewery is planned for the building. What if feasibility analysis determines that a project isn’t feasible? Sometimes, careful analysis reveals that redevelopment of a project is not feasible under current market conditions. It may be the case that prevailing rents in the local market simply cannot support the amount of investment required to revitalize a distressed structure. Although this is not the hoped-for result, the analysis is still valuable because it can help set reasonable expectations for the timeline of development and what may be possible at the site. One semester, students presented findings to public officials that the prevailing rents in the market were currently too low to attract private investor interest in rehabilitation of a historic building—but the students also pointed out that rents were trending up so the project could be feasible in the foreseeable future. Feasibility analysis that saves public officials time and frustration—not to mention funds—is valuable for a local government even when a project is found infeasible. Students understand that they cannot shrink from delivering bad news when necessary, though they strive to offer solutions and alternatives when doing so. Don’t forget the value of educating North Carolina graduate students If you submit a project for our talented graduate students, don’t do it solely for the benefit of your local government. Remember that you will be participating in the education of graduate students who will soon join your ranks as public officials, nonprofit leaders, and business professionals. Over 100 graduate students have taken some version of the community revitalization course and have provided sophisticated analysis to dozens of local governments at no charge. These students come from a variety of graduate programs, representing City & Regional Planning, Public Administration, Business, Public Health, Law, and Information & Library Science—and through a partnership between UNC and Duke University, Duke graduate students have occasionally joined the class over the years. As one student said in a letter after graduation: “I can state with 100% certainty that I would have never been considered for this job (much less offered) had it not been for the experiences I had in Community Revitalization Techniques. The folks at [my new firm] were impressed with the deliverables produced in the class, and the technical skills and project management skills I was able to develop…. Thanks again for running a great class! It paid off big time for me.” What if my project is too [insert adjective here] for students? Graduate student projects are limited to one semester of analysis—students receive instruction during the semester and submit interim assignments and final reports, and ultimately they receive a grade for the course. However, many projects don’t fit within the constraints of a semester. Sometimes projects require more community engagement, more presentations to elected officials, and longer time horizons than one semester. Sometimes local governments need first to determine the public interests for a project before proceeding. Sometimes local governments need support to drive the process forward, and they need experts to assist with identifying private developers and negotiating deal points, particularly for more complex and time-sensitive projects. Graduate students cannot perform those tasks during a semester-long course. If you think professional analysis is more appropriate for your project due to complexity or visibility or controversy or [insert appropriate word here], then you may prefer to utilize Development Finance Initiative professionals. See contact information at DFI’s website here. |

Published June 12, 2019 By Tyler Mulligan

Do you have a revitalization project that is a local government priority? Did you know that local governments can obtain real estate development feasibility analysis by UNC graduate student teams at no charge?

Since 2012, UNC faculty and staff associated with the Development Finance Initiative at the School of Government have worked with graduate student teams in a course on community revitalization to analyze revitalization projects for North Carolina communities at no charge. The School periodically requests project idea submissions from local government officials, and then students select their preferred projects. Student projects focus on attracting private sector investment for private (non-public) uses, such as converting a historic school into senior housing or a former fire station into a retail space (to understand what makes for an appealing student project and to submit a project online, click here). Over the course of a semester, students perform financial feasibility analysis to evaluate whether the private sector could accomplish the public’s revitalization goals, ranging from historic preservation to increasing downtown foot traffic after 5 pm. How is financial feasibility analysis useful to local governments, and how have local governments used student analysis in the past?

The role of financial feasibility analysis for revitalization projects

Revitalization projects are challenging. By definition, they typically involve neglected structures or underutilized land—hence the need for “revitalization.” The projects are often located in distressed or underperforming areas (usually characterized by blight, vacancy, and disinvestment), so the broader market is relatively weak. After all, if the market was strong, the private sector would have “revitalized” the project on its own. In these areas, there may have been little or no development activity for many years, making it difficult to convince lenders and investors that a project can work today. Unless the business case is obvious, private developers and investors won’t spend time identifying and researching projects in these distressed areas. In all of these instances, financial feasibility analysis can be helpful. It provides information to show whether or not a project is “feasible” in the sense that it could attract private investment. If a project can attract private investment, then local governments won’t have to spend their precious time and resources to revitalize the project.

What is financial feasibility analysis?

Financial feasibility analysis is an evaluation of project returns for a private development project. The analysis usually results in a financial model known as a pro forma. The pro forma includes a development budget, operating cash flows, and sources and uses of capital. It is designed to demonstrate expected returns with varying levels of debt, income, and expenses. The key to good financial feasibility, however, is careful analysis of the inputs to the pro forma. According to the academic literature, important inputs include the following:

- Plans, public hearings, and other prepared materials relevant to the project

- Parcel-by-parcel evaluation of current conditions and trends, such as sales trends, vacancy, land use, and ownership near the project

- Assessment of the suitability of the site for the project—that is, what sort of development can fit on the site given constraints such as zoning, grade, and environmental considerations

- Market analysis to identify prevailing rents and demand drivers for different uses for the project

In our graduate course in community revitalization, students spend much of the semester collecting and analyzing these inputs, culminating in a pro forma and financial feasibility report that summarizes the results of their analysis. Public officials are invited to attend students’ in-class presentations at the end of the semester.

How is financial feasibility analysis used by a private developer?

It is important to keep in mind that financial feasibility analysis does not make a development project happen. It merely shows whether or not development may be attractive to private developers and investors under certain assumed conditions. Executing the development project is another matter entirely.

For example, even if financial feasibility analysis makes a developer optimistic that a particular development project could be attractive to private investors, that doesn’t mean investors will line up at the developer’s door. First, the developer must assemble a development team, to include general contractors, architects, engineers, and legal and accounting firms. The team will take a closer look at the project and refine the assumptions. Second, the developer must convince lenders and investors to provide capital at a reasonable cost (cost of capital includes the interest rate for loans and return expectations for equity investments). Potential lenders and investors will scrutinize the project and the development team to determine whether the team has a solid track record with the category of project (for example, a retail project should be attempted by a team with retail experience).

Further, financial feasibility analysis makes important assumptions about development that are certain to change once the developer starts interacting with other members of the development team and financial decision-makers related to the project. The developer will be required to generate a more detailed (and almost always different) plan from the original feasibility analysis. It must be remembered that financial feasibility analysis is a research project—which is the reason it’s such a good fit for students and university experts—and as with all research projects, the conditions under which a project is executed in the field are certain to be different from the analysis performed in the lab.

Is financial feasibility analysis useful even though assumptions may change?

Even though assumptions such as rents, construction costs, and interest rates will change—sometimes significantly—from the original feasibility analysis, it is nonetheless very helpful to local governments. Just a few examples below show how local governments have used feasibility analysis by UNC graduate student teams.

What can be done with the old jail site?

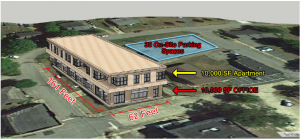

Feasibility Analysis: The Town of Wilkesboro was unsure of the future of the county’s soon-to-be-demolished jail, located on a key intersection in downtown next to the local Heritage Museum. Analysis determined that office and residential uses were financially feasible and students presented their findings to Town officials in November 2015. The student team was later invited to present their findings to Town Council in 2016. A two-story project was shown to generate attractive returns, giving the local government an idea of what it could expect from developers with its plan to demolish the jail and sell the property. Shown below is the diagram produced by the student team to illustrate how a feasible project could fit on the site of the old jail.

Result: Local private developer Finley Properties Commercial Development exceeded expectations for the site by proposing a four-story building with 18 condominiums and a restaurant. Follow the link to a news article to compare the students’ plan above to the private developer’s architectural rendering.

Attracting investor interest to downtown

Feasibility Analysis: Students evaluated the redevelopment potential of an iconic downtown building in Graham and provided a financial feasibility report to City officials, including an examination of market conditions in downtown.

Result: City officials circulated the report to downtown stakeholders and now give some credit to the student report for inspiring confidence in local investors, who began investing in development across downtown. The city planner found that “the analysis done by the Master’s students at UNC resulted in a product which private developers found accurate, thorough, and attainable.” The building analyzed by students also attracted investor interest and was sold at a price well above the expected price (article here). A microbrewery is planned for the building.

What if feasibility analysis determines that a project isn’t feasible?

Sometimes, careful analysis reveals that redevelopment of a project is not feasible under current market conditions. It may be the case that prevailing rents in the local market simply cannot support the amount of investment required to revitalize a distressed structure. Although this is not the hoped-for result, the analysis is still valuable because it can help set reasonable expectations for the timeline of development and what may be possible at the site. One semester, students presented findings to public officials that the prevailing rents in the market were currently too low to attract private investor interest in rehabilitation of a historic building—but the students also pointed out that rents were trending up so the project could be feasible in the foreseeable future. Feasibility analysis that saves public officials time and frustration—not to mention funds—is valuable for a local government even when a project is found infeasible. Students understand that they cannot shrink from delivering bad news when necessary, though they strive to offer solutions and alternatives when doing so.

Don’t forget the value of educating North Carolina graduate students

If you submit a project for our talented graduate students, don’t do it solely for the benefit of your local government. Remember that you will be participating in the education of graduate students who will soon join your ranks as public officials, nonprofit leaders, and business professionals. Over 100 graduate students have taken some version of the community revitalization course and have provided sophisticated analysis to dozens of local governments at no charge. These students come from a variety of graduate programs, representing City & Regional Planning, Public Administration, Business, Public Health, Law, and Information & Library Science—and through a partnership between UNC and Duke University, Duke graduate students have occasionally joined the class over the years. As one student said in a letter after graduation:

“I can state with 100% certainty that I would have never been considered for this job (much less offered) had it not been for the experiences I had in Community Revitalization Techniques. The folks at [my new firm] were impressed with the deliverables produced in the class, and the technical skills and project management skills I was able to develop…. Thanks again for running a great class! It paid off big time for me.”

What if my project is too [insert adjective here] for students?

Graduate student projects are limited to one semester of analysis—students receive instruction during the semester and submit interim assignments and final reports, and ultimately they receive a grade for the course. However, many projects don’t fit within the constraints of a semester. Sometimes projects require more community engagement, more presentations to elected officials, and longer time horizons than one semester. Sometimes local governments need first to determine the public interests for a project before proceeding. Sometimes local governments need support to drive the process forward, and they need experts to assist with identifying private developers and negotiating deal points, particularly for more complex and time-sensitive projects. Graduate students cannot perform those tasks during a semester-long course. If you think professional analysis is more appropriate for your project due to complexity or visibility or controversy or [insert appropriate word here], then you may prefer to utilize Development Finance Initiative professionals. See contact information at DFI’s website here.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.

2 Responses to “Local Governments: Financial Feasibility Analysis for Your Revitalization Projects”

Lynda Clayton

I’m very interested in the feasibility study on a particular property in the center of my downtown commercial district. It has been vacant for as long as I can remember, in disrepair and looks awful! The property owner resides out-of-town and isn’t even interested in replacing broken windows (even when offered financial assistance). What would be the steps to go through to have this building looked at and analyzed?

Tyler Mulligan

Thank you for your question. Student teams prefer to analyze (1) revitalization projects that are owned by a local government, (2) projects that local governments may acquire, and (3) projects in which local government involvement has been requested (such as providing a loan for redevelopment). Occasionally, students will evaluate projects that are privately owned but represent important public interests, such as iconic historic structures that could benefit from tax credit financing and other complicated financing tools. To submit a project for consideration, please provide project information through the Grad Student Revitalization Project Submission Webform.

You mentioned that the owner does not appear to be interested in repairing the building. The local government could consider code enforcement options as described in my blog post: Maintenance of vacant or neglected commercial buildings: options for NC local governments.