|

|

Student Corner: New Markets Tax Credits: The Process and Key ConsiderationsBy CED Program Interns & StudentsPublished April 9, 2015This blog post is a follow up to the Primer on New Markets Tax Credits. This is the second in a series of posts that seek to provide detailed information on the NMTC program and process. The Process The flow chart below illustrates the basic uses of funds during a New Markets Tax Credits (NMTC project). For a more thorough explanation of the terms used in this description please refer to the Primer on New Market Tax Credits.

This is a highly simplified example, and there are many other implications to consider during a NMTC project. Key Considerations There are fees associated with NMTC transaction that often go overlooked by developers utilizing the process for the first time. The CDE generally charges a fee ranging anywhere from 1-3% of total QEI or project cost. In this case, a 3% fee would equal $300,000 at closing. This is not in addition to the project cost, but is subtracted from it, meaning that the actual QEI of the project becomes $9.7M ($10M – $300k). CDEs may charge origination fees, management fees, and closing fees as a part of the transaction. In addition to transaction fees, there is recapture risk associated with a NMTC transaction. Under the program guidelines, tax credits can be recaptured if the CDE ceases to be CDFI certified, if “substantially all” (generally 85%) of the QEI proceeds are no longer continuously invested in QLICI’s, or if the CDE redeems the equity investment. In general recapture risk is low so long as compliance is up to date and the transaction is structured properly. But the penalties for recapture are severe. If the recapture provisions are triggered at any point during the seven-year compliance period, 100 percent of the credits are recaptured, and the equity investor loses their entire investment. As a result of this, the strength of the CDE should be a key consideration for the tax investor. The tax investor must have confidence that the CDE will manage the investment during the seven-year compliance period in a way that does not put their investment at risk. An additional benefit of NMTC’s is that they can be blended or “twinned” with other tax credit programs such as Historic Tax Credits and Renewable-Energy Investment Tax Credits. Utilizing multiple tax credit programs can create lucrative investment opportunities out of projects that would have been otherwise unattractive. Perhaps the most important point to consider regarding NMTC’s is that they bear the risk of being discontinued. The original Community Renewal Tax Relief Act that created the credits was initially authorized through 2007. It has been extended on a year by year basis through annual votes by Congress. The NMTC program expired at the end of 2014, but a new bill was introduced in February of this year that would extend the program indefinitely. You can track the bill here. This post has sought to provide a blueprint for understanding the NMTC process and provide some key items to consider before undertaking a NMTC project. For additional information on NMTC’s check out this 2013 report. David Summers is a graduate student in the Kenan-Flagler Business School at UNC-Chapel Hill. He is also a Community Revitalization Fellow with the Development Finance Initiative.

|

Published April 9, 2015 By CED Program Interns & Students

This blog post is a follow up to the Primer on New Markets Tax Credits. This is the second in a series of posts that seek to provide detailed information on the NMTC program and process.

The Process

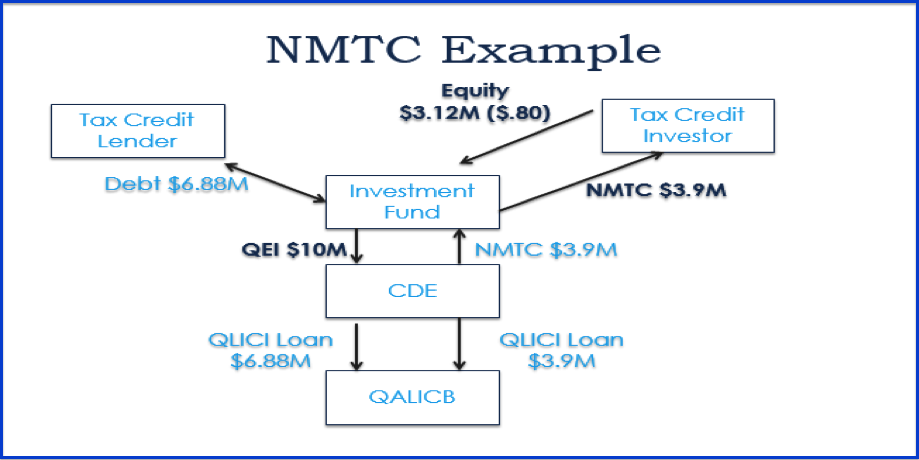

The flow chart below illustrates the basic uses of funds during a New Markets Tax Credits (NMTC project). For a more thorough explanation of the terms used in this description please refer to the Primer on New Market Tax Credits.

- In this example we have a $10M development project being carried out in a QLIC (Qualified Low Income Community). The NMTC is equal to 39% of the total QEI (Qualified Equity Investment) of the project, which in this case is $3.9M (39% x $10M). It is important to note that this is not the amount that the tax credit investor is paying into the QEI, but rather the amount of tax benefit that will be received over the next seven years. In this example, the current tax credit price is $0.80. Therefore, the tax credit investor is paying $0.80 today for every dollar of tax benefit to be received in the future. In other words, they will pay $3.12M (0.80 x $3.9M) today in exchange for $3.9M of tax credits over the next seven years.

- Once the tax credit investor’s equity contribution has been calculated, we can subtract that number from the total QEI to derive the amount of debt needed on this project. In this case, we would need $6.88M of debt ($10M – $3.12M) to complete the $10M QEI.

- The $10M QEI is placed into an investment fund that is then invested into a CDE (Community Development Entity). The CDE then invests those funds into QALICB (Qualified Active Low Income Business) in the form of QLICI (Qualified Low Income Community Investment).

- Finally, the CDE passes the tax credits and interest earned back to the investment fund, where they distributed to the tax credit investor and the lender. The tax credit investor receives the $3.9M tax credit over the next seven years, paid out in increments of 5% over the first three years, and 6% over the final four years (5% + 5% +5% +6% + 6% +6% + 6% = 39%).

This is a highly simplified example, and there are many other implications to consider during a NMTC project.

Key Considerations

There are fees associated with NMTC transaction that often go overlooked by developers utilizing the process for the first time. The CDE generally charges a fee ranging anywhere from 1-3% of total QEI or project cost. In this case, a 3% fee would equal $300,000 at closing. This is not in addition to the project cost, but is subtracted from it, meaning that the actual QEI of the project becomes $9.7M ($10M – $300k). CDEs may charge origination fees, management fees, and closing fees as a part of the transaction.

In addition to transaction fees, there is recapture risk associated with a NMTC transaction. Under the program guidelines, tax credits can be recaptured if the CDE ceases to be CDFI certified, if “substantially all” (generally 85%) of the QEI proceeds are no longer continuously invested in QLICI’s, or if the CDE redeems the equity investment. In general recapture risk is low so long as compliance is up to date and the transaction is structured properly. But the penalties for recapture are severe. If the recapture provisions are triggered at any point during the seven-year compliance period, 100 percent of the credits are recaptured, and the equity investor loses their entire investment. As a result of this, the strength of the CDE should be a key consideration for the tax investor. The tax investor must have confidence that the CDE will manage the investment during the seven-year compliance period in a way that does not put their investment at risk.

An additional benefit of NMTC’s is that they can be blended or “twinned” with other tax credit programs such as Historic Tax Credits and Renewable-Energy Investment Tax Credits. Utilizing multiple tax credit programs can create lucrative investment opportunities out of projects that would have been otherwise unattractive.

Perhaps the most important point to consider regarding NMTC’s is that they bear the risk of being discontinued. The original Community Renewal Tax Relief Act that created the credits was initially authorized through 2007. It has been extended on a year by year basis through annual votes by Congress. The NMTC program expired at the end of 2014, but a new bill was introduced in February of this year that would extend the program indefinitely. You can track the bill here.

This post has sought to provide a blueprint for understanding the NMTC process and provide some key items to consider before undertaking a NMTC project. For additional information on NMTC’s check out this 2013 report.

David Summers is a graduate student in the Kenan-Flagler Business School at UNC-Chapel Hill. He is also a Community Revitalization Fellow with the Development Finance Initiative.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.