|

|

Student Corner: New Rules on Historic Rehabilitation Tax Credits, and Where Credits are DueBy CED Program Interns & StudentsPublished October 15, 2015

The Credits The now-expired state program had made the otherwise cost-prohibitive redevelopment of some historic buildings possible by extending tax credits to individuals and entities that held title to the structures (for an example of how the old credits were applied to a redevelopment project in Durham, see this post). According to the North Carolina Department of Cultural Resources, the tax credit program was responsible for encouraging nearly $1.5 billion in private investment in North Carolina communities between 1998 and 2015. Under the old system, income-producing properties were eligible for credits equal to 20 percent of their rehabilitation expenditures (which did not include expenditures such as property acquisition, building enlargement, site work, or personal property). When taken together with the 20 percent federal historic rehabilitation tax credit available to income-producing structures, such a structure could receive, under the old system, a credit equal to 40 percent of its rehabilitation expenditures. North Carolina also had a credit available for non-incoming-producing structures (which are not eligible for federal tax credits) equal to 30 percent of rehabilitation expenditures. Nine months after that state tax credit program expired; 2015’s Appropriations Act (beginning on page 409) revived the program. The new tax credits are effective January 1, 2016 and applicable to expenditures incurred until the end of 2019. They differ from those that were available prior to 2015, though; they are in some ways more flexible and in others, more restricted. What does the new legislation do?

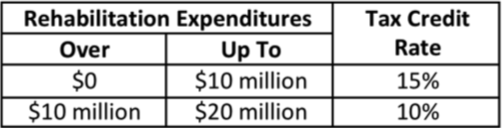

For income-producing structures, the base amount of the credit relates to the amount of rehabilitation expenditures.

The amount of credit allowed under this section with respect to qualified rehabilitation expenditures for an income-producing certified historic structure may not exceed four million five hundred thousand dollars ($4,500,000). The amount of credit allowed under this section with respect to rehabilitation expenses for a non-income-producing certified historic structure may not exceed twenty-two thousand five hundred dollars ($22,500) per discrete property parcel.

Development tier bonus – An amount equal to five percent (5%) of qualified rehabilitation expenditures not exceeding twenty million dollars ($20,000,000) if the certified historic structure is located in a development tier one or two area. (To determine in which development tier areas a structure is located, see the NC Department of Commerce’s annual tier designations.) Targeted investment bonus – An amount equal to five percent (5%) of qualified rehabilitation expenditures not exceeding twenty million dollars ($20,000,000) if the certified historic structure is located on an eligible targeted investment site. The legislation defines an eligible targeted investment site as: A site located in this State that satisfies all of the following conditions:

If an owner of a pass-through entity that has qualified for the credit allowed under G.S. 105-129.100 disposes of all or a portion of the owner’s interest in the pass-through entity within five years from the date the rehabilitated historic structure is placed in service and the owner’s interest in the pass-through entity is reduced to less than two-thirds of the owner’s interest in the pass-through entity at the time the historic structure was placed in service, the owner forfeits a portion of the credit. The amount forfeited is determined by multiplying the amount of credit by the percentage reduction in ownership and then multiplying that product by the forfeiture percentage. The forfeiture percentage equals the recapture percentage found in the table in section 50(a)(1)(B) of the Code.

The prior legislation stated: The entire credit may not be taken for the taxable year in which the property is placed in service but must be taken in five equal installments beginning with the taxable year in which the property is placed in service. Any unused portion of the credit may be carried forward for the succeeding five years. A credit allowed under this Article may not exceed the amount of the tax against which it is claimed for the taxable year reduced by the sum of all credits allowed, except payments of tax made by or on behalf of the taxpayer. The new legislation states: A taxpayer may claim a credit allowed by this Article on a return filed for the taxable year in which the certified historic structure was placed into service. When an income-producing certified historic structure as defined in G.S. 105-129.100 is placed into service in two or more phases in different years, the amount of credit that may be claimed in a year is the amount based on the qualified rehabilitation expenditures associated with the phase placed into service during that year.

The prior legislation stated: The credits provided in this Article are allowed against the income taxes levied in Article 4 of this Chapter. The new legislation states: The credits provided in this Article are allowed against the franchise tax imposed in Article 3 of this Chapter, the income taxes levied in Article 4 of this Chapter, or the gross premiums tax imposed in Article 8B of this Chapter. The taxpayer may take a credit allowed by this Article against only one of the taxes against which it is allowed. The taxpayer must elect the tax against which a credit will be claimed when filing the return on which it is claimed, and this election is binding. Any carryforwards of a credit must be claimed against the same tax.

This Article expires for qualified rehabilitation expenditures and rehabilitation expenses incurred on or after January 1, 2020. Looking Forward Though the new program will alter the calculus for some of those that would redevelop historic structures in North Carolina communities, it revives a tool that can be critical for community building. Andrew Trump is a student in the Master of City and Regional Planning and Master of Public Administration programs at UNC-Chapel Hill and a fellow at the Development Finance Initiative. |

Published October 15, 2015 By CED Program Interns & Students

North Carolina’s historic rehabilitation tax credits program—a critical tool for communities around the state that sought to put historic structures to productive economic use—expired on December 31, 2014. The credits are back, though they differ in some important ways from those that existed prior to 2015. This post explains how the new state tax credits program will work.

North Carolina’s historic rehabilitation tax credits program—a critical tool for communities around the state that sought to put historic structures to productive economic use—expired on December 31, 2014. The credits are back, though they differ in some important ways from those that existed prior to 2015. This post explains how the new state tax credits program will work.

The Credits

The now-expired state program had made the otherwise cost-prohibitive redevelopment of some historic buildings possible by extending tax credits to individuals and entities that held title to the structures (for an example of how the old credits were applied to a redevelopment project in Durham, see this post). According to the North Carolina Department of Cultural Resources, the tax credit program was responsible for encouraging nearly $1.5 billion in private investment in North Carolina communities between 1998 and 2015.

Under the old system, income-producing properties were eligible for credits equal to 20 percent of their rehabilitation expenditures (which did not include expenditures such as property acquisition, building enlargement, site work, or personal property). When taken together with the 20 percent federal historic rehabilitation tax credit available to income-producing structures, such a structure could receive, under the old system, a credit equal to 40 percent of its rehabilitation expenditures. North Carolina also had a credit available for non-incoming-producing structures (which are not eligible for federal tax credits) equal to 30 percent of rehabilitation expenditures.

Nine months after that state tax credit program expired; 2015’s Appropriations Act (beginning on page 409) revived the program. The new tax credits are effective January 1, 2016 and applicable to expenditures incurred until the end of 2019. They differ from those that were available prior to 2015, though; they are in some ways more flexible and in others, more restricted. What does the new legislation do?

- It creates a new credit rate

For income-producing structures, the base amount of the credit relates to the amount of rehabilitation expenditures.

- It imposes a cap

The amount of credit allowed under this section with respect to qualified rehabilitation expenditures for an income-producing certified historic structure may not exceed four million five hundred thousand dollars ($4,500,000).

The amount of credit allowed under this section with respect to rehabilitation expenses for a non-income-producing certified historic structure may not exceed twenty-two thousand five hundred dollars ($22,500) per discrete property parcel.

- It makes two bonuses available to income-producing structures

Development tier bonus – An amount equal to five percent (5%) of qualified rehabilitation expenditures not exceeding twenty million dollars ($20,000,000) if the certified historic structure is located in a development tier one or two area.

(To determine in which development tier areas a structure is located, see the NC Department of Commerce’s annual tier designations.)

Targeted investment bonus – An amount equal to five percent (5%) of qualified rehabilitation expenditures not exceeding twenty million dollars ($20,000,000) if the certified historic structure is located on an eligible targeted investment site.

The legislation defines an eligible targeted investment site as:

A site located in this State that satisfies all of the following conditions:

- It was used as a manufacturing facility or for purposes ancillary to manufacturing, as a warehouse for selling agricultural products, or as a public or private utility.

- It is a certified historic structure.

- It has been at least sixty-five percent (65%) vacant for a period of at least two years immediately preceding the date the eligibility certification is made.

- It requires a five-year hold period for the property

If an owner of a pass-through entity that has qualified for the credit allowed under G.S. 105-129.100 disposes of all or a portion of the owner’s interest in the pass-through entity within five years from the date the rehabilitated historic structure is placed in service and the owner’s interest in the pass-through entity is reduced to less than two-thirds of the owner’s interest in the pass-through entity at the time the historic structure was placed in service, the owner forfeits a portion of the credit. The amount forfeited is determined by multiplying the amount of credit by the percentage reduction in ownership and then multiplying that product by the forfeiture percentage. The forfeiture percentage equals the recapture percentage found in the table in section 50(a)(1)(B) of the Code.

- It allows credits to be taken in one installment

The prior legislation stated:

The entire credit may not be taken for the taxable year in which the property is placed in service but must be taken in five equal installments beginning with the taxable year in which the property is placed in service. Any unused portion of the credit may be carried forward for the succeeding five years. A credit allowed under this Article may not exceed the amount of the tax against which it is claimed for the taxable year reduced by the sum of all credits allowed, except payments of tax made by or on behalf of the taxpayer.

The new legislation states:

A taxpayer may claim a credit allowed by this Article on a return filed for the taxable year in which the certified historic structure was placed into service. When an income-producing certified historic structure as defined in G.S. 105-129.100 is placed into service in two or more phases in different years, the amount of credit that may be claimed in a year is the amount based on the qualified rehabilitation expenditures associated with the phase placed into service during that year.

- It applies credits against additional types of taxes

The prior legislation stated:

The credits provided in this Article are allowed against the income taxes levied in Article 4 of this Chapter.

The new legislation states:

The credits provided in this Article are allowed against the franchise tax imposed in Article 3 of this Chapter, the income taxes levied in Article 4 of this Chapter, or the gross premiums tax imposed in Article 8B of this Chapter. The taxpayer may take a credit allowed by this Article against only one of the taxes against which it is allowed. The taxpayer must elect the tax against which a credit will be claimed when filing the return on which it is claimed, and this election is binding. Any carryforwards of a credit must be claimed against the same tax.

- It extends credits only until the end of 2019

This Article expires for qualified rehabilitation expenditures and rehabilitation expenses incurred on or after January 1, 2020.

Looking Forward

Though the new program will alter the calculus for some of those that would redevelop historic structures in North Carolina communities, it revives a tool that can be critical for community building.

Andrew Trump is a student in the Master of City and Regional Planning and Master of Public Administration programs at UNC-Chapel Hill and a fellow at the Development Finance Initiative.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.