|

|

Student Corner: Property-Assessed Clean Energy (PACE) Programs in North Carolina: Part IIBy CED Program Interns & StudentsPublished September 7, 2017There are several ways for state and local leaders to promote investments in their communities and reduce utility costs for residents. One tool that has been often overlooked in North Carolina are Property-Assessed Clean Energy (PACE) programs. This post examines the benefits and drawbacks of commercial and residential PACE programs. A previous blog post outlined the PACE program in general and its history in North Carolina. All PACE assessments follow the general structure outlined in the first blog post on this issue. This framework allows property owners to install energy efficiency (EE) or renewable energy (RE) upgrades with little or no up-front costs.  Source: National Renewable Energy Lab It is important to remember that PACE assessments are governed by state and local laws regarding special assessments (see an overview of North Carolina’s law here), and that there is a considerable amount of flexibility in how programs are structured. For example, a PACE program can be capitalized through direct government appropriations (public funds) or through government issued bonds (private funds). Programs can also be established at the state, regional, or municipal level. A property owner or developer interested in securing PACE financing needs to apply to a specific commercial (C-PACE) or residential (R-PACE) program. Applicants should be aware that there can be multiple programs within a state, each with its own customized structure and rules. C-PACE Programs C-PACE programs have financed $322 million in energy efficiency or renewable energy improvements since 2009. Projects covered by C-PACE programs can include agricultural, industrial, multifamily residential (more than four units), retail and warehouses. The Energy Department has issued guidelines outlining the thirteen-step process for local governments to implement a C-PACE program, in addition to a table describing the advantages and disadvantages (see below). Programs can be managed by different entities. For example, Connecticut’s legislature founded a “Green Bank” to manage its C-PACE program (and other clean energy programs), while Texas’ program is managed by a non-profit organization. Much of the information pertinent for developers (precise interest rates, loan-to-value ratios, application process, types of properties eligible, etc.) are determined by the specific C-PACE program. Generally, each C-PACE assessment requires the approval of mortgage lender(s) involved in the project, as the assessment may affect the seniority of their lien.  Additional resources on C-PACE programs:

R-PACE Programs R-PACE programs allow owners of single family homes to take advantage of PACE financing. Six states have active R-PACE programs financed $3.3 billion in improvements over 130,000 projects. However, R-PACE has been somewhat controversial. The Federal Housing Administration and Federal Housing Finance Agency have voiced concerns that old R-PACE programs may encourage irresponsible lending. Consumer groups, such as the National Consumer Law Center (NCLC), fear that poorly designed R-PACE programs and laws could exploit some homeowners. Driven by these concerns, the Federal Housing Finance Agency (FHFA) originally prohibited Fannie Mae or Freddie Mac from purchasing or securitizing mortgages attached to properties with PACE assessments. However, in 2016 the Energy Department issued new guidelines for R-PACE programs that addressed these issues and allows Fannie Mae and Freddie Mac to purchase related mortgages. NCLC these changes as a significant improvement, but has lingering concerns with R-PACE programs. R-PACE programs can be a useful tool for state and local governments to overcome some of the largest barriers to investments in energy efficiency and renewable energy installations. However, policymakers and their partners should closely study the Energy Department guidelines and NCLC’s critiques before creating a new program. Due to the high administrative cost of creating a program, R-PACE may be most appropriate for large municipalities, communities with high utility costs, or for areas where renewable energy projects are financially attractive. Additional Resources on R-PACE Programs:

Bradley Harris is a Masters student at Duke’s Sanford School of Public Policy as well as an MBA Candidate at the UNC-Chapel Hill Kenan Flagler Business School. Bradley is also currently a Community Revitalization Fellow with the Development Finance Initiative. |

Published September 7, 2017 By CED Program Interns & Students

There are several ways for state and local leaders to promote investments in their communities and reduce utility costs for residents. One tool that has been often overlooked in North Carolina are Property-Assessed Clean Energy (PACE) programs. This post examines the benefits and drawbacks of commercial and residential PACE programs. A previous blog post outlined the PACE program in general and its history in North Carolina.

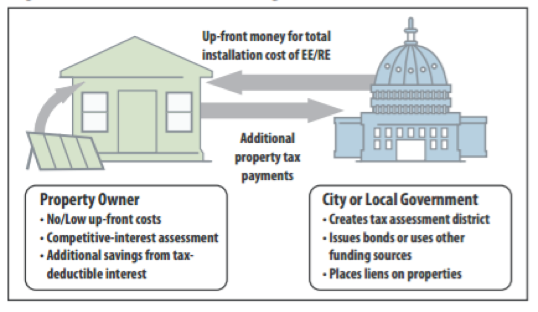

All PACE assessments follow the general structure outlined in the first blog post on this issue. This framework allows property owners to install energy efficiency (EE) or renewable energy (RE) upgrades with little or no up-front costs.

Source: National Renewable Energy Lab

It is important to remember that PACE assessments are governed by state and local laws regarding special assessments (see an overview of North Carolina’s law here), and that there is a considerable amount of flexibility in how programs are structured. For example, a PACE program can be capitalized through direct government appropriations (public funds) or through government issued bonds (private funds). Programs can also be established at the state, regional, or municipal level.

A property owner or developer interested in securing PACE financing needs to apply to a specific commercial (C-PACE) or residential (R-PACE) program. Applicants should be aware that there can be multiple programs within a state, each with its own customized structure and rules.

C-PACE Programs

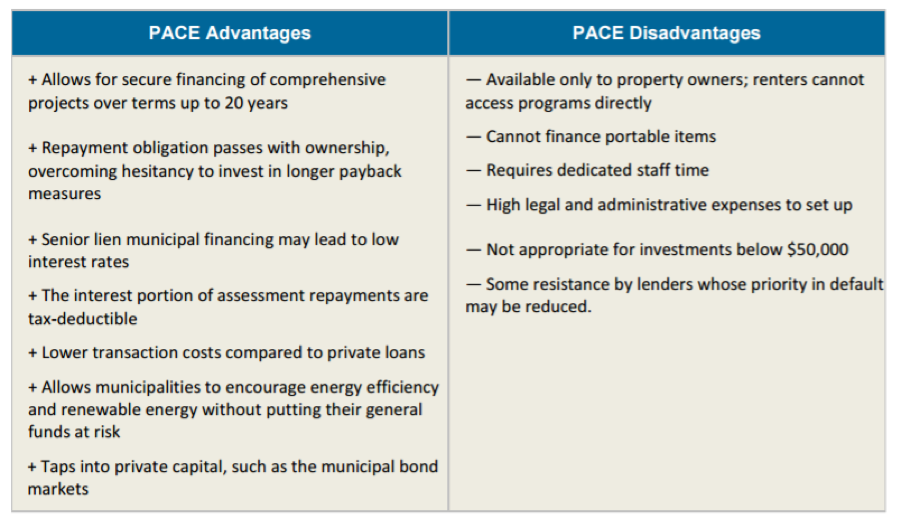

C-PACE programs have financed $322 million in energy efficiency or renewable energy improvements since 2009. Projects covered by C-PACE programs can include agricultural, industrial, multifamily residential (more than four units), retail and warehouses. The Energy Department has issued guidelines outlining the thirteen-step process for local governments to implement a C-PACE program, in addition to a table describing the advantages and disadvantages (see below). Programs can be managed by different entities. For example, Connecticut’s legislature founded a “Green Bank” to manage its C-PACE program (and other clean energy programs), while Texas’ program is managed by a non-profit organization.

Much of the information pertinent for developers (precise interest rates, loan-to-value ratios, application process, types of properties eligible, etc.) are determined by the specific C-PACE program. Generally, each C-PACE assessment requires the approval of mortgage lender(s) involved in the project, as the assessment may affect the seniority of their lien.

Additional resources on C-PACE programs:

- Energy Department Primer (11 slide PowerPoint)

- Energy Department Webinars

- National Renewable Energy Lab Fact Sheet

- PACENation C-PACE 2009-2016 Market Overview

R-PACE Programs

R-PACE programs allow owners of single family homes to take advantage of PACE financing. Six states have active R-PACE programs financed $3.3 billion in improvements over 130,000 projects.

However, R-PACE has been somewhat controversial. The Federal Housing Administration and Federal Housing Finance Agency have voiced concerns that old R-PACE programs may encourage irresponsible lending. Consumer groups, such as the National Consumer Law Center (NCLC), fear that poorly designed R-PACE programs and laws could exploit some homeowners. Driven by these concerns, the Federal Housing Finance Agency (FHFA) originally prohibited Fannie Mae or Freddie Mac from purchasing or securitizing mortgages attached to properties with PACE assessments. However, in 2016 the Energy Department issued new guidelines for R-PACE programs that addressed these issues and allows Fannie Mae and Freddie Mac to purchase related mortgages. NCLC these changes as a significant improvement, but has lingering concerns with R-PACE programs.

R-PACE programs can be a useful tool for state and local governments to overcome some of the largest barriers to investments in energy efficiency and renewable energy installations. However, policymakers and their partners should closely study the Energy Department guidelines and NCLC’s critiques before creating a new program. Due to the high administrative cost of creating a program, R-PACE may be most appropriate for large municipalities, communities with high utility costs, or for areas where renewable energy projects are financially attractive.

Additional Resources on R-PACE Programs:

- Energy Department Webinar (45 minutes)

- Energy Department Guidelines Appendix – provides links to additional resources on R-PACE programs. The Appendix is organized into nine different categories of resources.

- California Banking and Finance Committee Backgrounder (written before the Energy Department updated its guidelines)

- Testimony of Alfred M. Pollard, FHFA General Counsel before the California Legislature (written before the Energy Department updated its guidelines)

Bradley Harris is a Masters student at Duke’s Sanford School of Public Policy as well as an MBA Candidate at the UNC-Chapel Hill Kenan Flagler Business School. Bradley is also currently a Community Revitalization Fellow with the Development Finance Initiative.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.