|

|

Student Corner: The Relationship between Infrastructure and Private InvestmentBy CED Program Interns & StudentsPublished July 2, 2015

Digging a little deeper, the ULI survey asked public and private respondents which infrastructure-related factors companies consider when making a real estate investment. Not surprisingly telecommunications and connectivity is the most contemplated type of infrastructure driving real estate investment decisions. Connectivity and broadband infrastructure has been dealt with in other posts on this blog (here and here). Behind telecommunication systems, roads and bridges, and reliable and affordable energy were also top considerations. Respondents were also asked to prioritize the need for improvement of the various types of infrastructure in their city/metropolitan area. When it came to priorities, the most respondents identified transit services, roads and bridges, and pedestrian infrastructure as priorities. However, when it came to perceptions of infrastructure quality, transportation related infrastructure scored at the bottom of the list. This suggests that there is a significant need for investment in transportation-related infrastructure rehab and construction. By updating, improving, and extending infrastructure, cities and towns can remain competitive. Municipalities can utilize their infrastructure investments as an advantage over their peers in terms of attracting real estate investment. This study shows that infrastructure and transportation in particular should be a key focus when it comes to thinking about encouraging and supporting new businesses and private development. The ULI asked respondents what they perceived were the most significant trends or issues affecting infrastructure. The number one factor they identified is the public’s willingness or ability to pay for infrastructure. Consequently the public has an important role to play when it comes to helping fund infrastructure. There is a continued push for private development to pay for infrastructure and remain financially sustainable over the life of the infrastructure. However, given the high needs and priorities of infrastructure investment, and limited public resources available, new approaches are going to be needed. In fact, according to the study, public-private collaboration is the number one way that public and private respondents anticipate new infrastructure to be paid for. Value-capture strategies and negotiated exactions were the number two and three methods respectively. These responses on funding sources ranked higher than income and real estate taxes or contributions from the federal and state governments. This suggests that the future of infrastructure funding will be much more collaborative and require innovative approaches. Public entities will need to be active and “at the table” to make infrastructure investments and the consequential real estate development a reality. While conventional grants, public financing and tax increases may have worked in the past; new strategies will need to be employed in the future. Going forward, traditional techniques may need to be bundled with innovative approaches especially at the municipal level. Public and private cooperation will be crucial to successful funding efforts as pooled resources, pioneering methods, and creative partnerships are necessary for a successful outcome as we face aging infrastructure, changing transportation preferences, and limited federal and state funding. Value-capture techniques in particular take public and private collaboration between developers and local municipalities, but can be a particularly effective tool as part of a larger infrastructure and real estate development joint effort. By thinking creatively and developing partnerships with real estate developers, the public and local communities can overcome reluctance to invest in and pay for costly infrastructure improvements. This in turn will go a long way to encourage and support private development in your community. Ben Lesher is a graduate student in both the Master of City and Regional Planning program and the Kenan-Flagler Business School at UNC-Chapel Hill. He is also a Fellow with the Development Finance Initiative. |

Published July 2, 2015 By CED Program Interns & Students

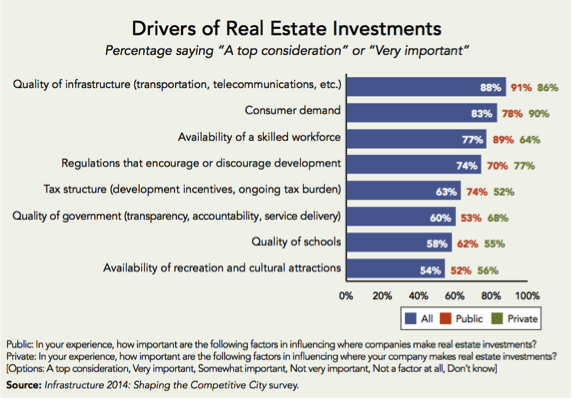

According to a recent study, infrastructure is one of the most important drivers of real estate investment. This illustrates how the government, and local municipalities in particular, can play a significant role in supporting private real estate development. Supplying public infrastructure can be one tool that municipalities and governments use to encourage and incentivize private development within their jurisdiction. A recent study by the Urban Land Institute (ULI), called Infrastructure 2014: Shaping the Competitive City, surveyed both the public and private sector on issues related to infrastructure and real estate development. Their findings ranked the “drivers” of real estate investments. Quality of infrastructure (transportation, telecommunications, etc.) was at the top of the list of respondents, behind consumer demand and availability of a skilled workforce. Providing high quality infrastructure can be an important recruiting tool when it comes to attracting private development.

According to a recent study, infrastructure is one of the most important drivers of real estate investment. This illustrates how the government, and local municipalities in particular, can play a significant role in supporting private real estate development. Supplying public infrastructure can be one tool that municipalities and governments use to encourage and incentivize private development within their jurisdiction. A recent study by the Urban Land Institute (ULI), called Infrastructure 2014: Shaping the Competitive City, surveyed both the public and private sector on issues related to infrastructure and real estate development. Their findings ranked the “drivers” of real estate investments. Quality of infrastructure (transportation, telecommunications, etc.) was at the top of the list of respondents, behind consumer demand and availability of a skilled workforce. Providing high quality infrastructure can be an important recruiting tool when it comes to attracting private development.

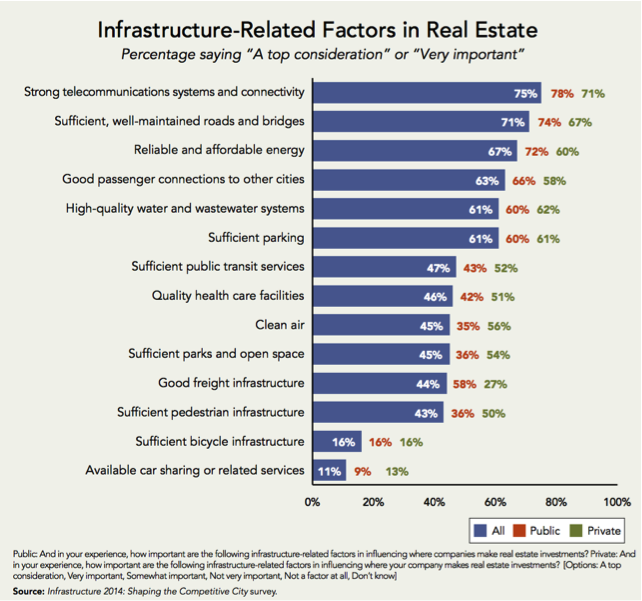

Digging a little deeper, the ULI survey asked public and private respondents which infrastructure-related factors companies consider when making a real estate investment. Not surprisingly telecommunications and connectivity is the most contemplated type of infrastructure driving real estate investment decisions. Connectivity and broadband infrastructure has been dealt with in other posts on this blog (here and here). Behind telecommunication systems, roads and bridges, and reliable and affordable energy were also top considerations.

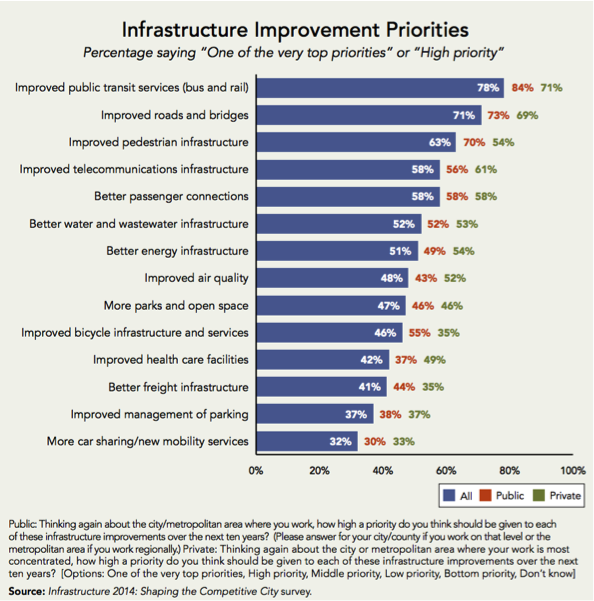

Respondents were also asked to prioritize the need for improvement of the various types of infrastructure in their city/metropolitan area. When it came to priorities, the most respondents identified transit services, roads and bridges, and pedestrian infrastructure as priorities. However, when it came to perceptions of infrastructure quality, transportation related infrastructure scored at the bottom of the list. This suggests that there is a significant need for investment in transportation-related infrastructure rehab and construction. By updating, improving, and extending infrastructure, cities and towns can remain competitive. Municipalities can utilize their infrastructure investments as an advantage over their peers in terms of attracting real estate investment. This study shows that infrastructure and transportation in particular should be a key focus when it comes to thinking about encouraging and supporting new businesses and private development.

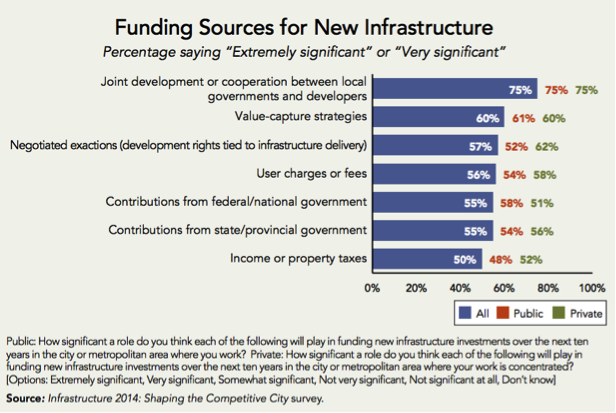

The ULI asked respondents what they perceived were the most significant trends or issues affecting infrastructure. The number one factor they identified is the public’s willingness or ability to pay for infrastructure. Consequently the public has an important role to play when it comes to helping fund infrastructure. There is a continued push for private development to pay for infrastructure and remain financially sustainable over the life of the infrastructure. However, given the high needs and priorities of infrastructure investment, and limited public resources available, new approaches are going to be needed. In fact, according to the study, public-private collaboration is the number one way that public and private respondents anticipate new infrastructure to be paid for. Value-capture strategies and negotiated exactions were the number two and three methods respectively. These responses on funding sources ranked higher than income and real estate taxes or contributions from the federal and state governments. This suggests that the future of infrastructure funding will be much more collaborative and require innovative approaches.

Public entities will need to be active and “at the table” to make infrastructure investments and the consequential real estate development a reality. While conventional grants, public financing and tax increases may have worked in the past; new strategies will need to be employed in the future. Going forward, traditional techniques may need to be bundled with innovative approaches especially at the municipal level. Public and private cooperation will be crucial to successful funding efforts as pooled resources, pioneering methods, and creative partnerships are necessary for a successful outcome as we face aging infrastructure, changing transportation preferences, and limited federal and state funding. Value-capture techniques in particular take public and private collaboration between developers and local municipalities, but can be a particularly effective tool as part of a larger infrastructure and real estate development joint effort. By thinking creatively and developing partnerships with real estate developers, the public and local communities can overcome reluctance to invest in and pay for costly infrastructure improvements. This in turn will go a long way to encourage and support private development in your community.

Ben Lesher is a graduate student in both the Master of City and Regional Planning program and the Kenan-Flagler Business School at UNC-Chapel Hill. He is also a Fellow with the Development Finance Initiative.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.

One Response to “Student Corner: The Relationship between Infrastructure and Private Investment”

Myers & Myers Real Estate

Great article, you are absolutely correct. I am a real estate agent in Albuquerque NM. Albuquerque and Rio Rancho utilize Public Improvement Districts to help developers cover the cost of infrastructure such as roads, bridges, parks, water and sewer lines.

The city will issue bonds to cover the costs of the city required infrastructure in a residential subdivision. The bonds are paid back by the home owners over time. Many of these residential developments would not take place if not for the Public Improvement districts.