|

|

Student Corner: Where and How? – The TRF Model for Community InvestmentBy CED Program Interns & StudentsPublished November 16, 2017

In 2001, the Reinvestment Fund designed a market value analysis system to help this investment decision making process. The Reinvestment Fund (TRF) is a Philadelphia based community development financial institution that brings together individual investors, banks, government officials, private foundations and faith-based and community organizations to invest in communities. The market value analysis or MVA is a data-based tool designed by TRF to inform community revitalization and manage neighborhood change. Using spatial and statistical analysis, it identifies and characterizes local conditions throughout a specific locality and creates a typology or index of residential real estate markets. In Philadelphia for example, the MVA categorizes block groups as “regional choice/high value”, “steady”, “transitional”, or “distressed”. The tool ultimately allows for stakeholders to have a common understanding of the market types within a locality that would allow for public, nonprofit and community organizations to engage accordingly and move towards the creation of coordinated community investment and strategic service delivery. Every single MVA is unique but consistently includes:

The tool analyzes conditions at the community and the block group level, and can be used to both highlight market challenges as well as the nodes of strength in order to inform investment strategies. This type of data-based analysis has been done several places across the country such as Philadelphia, Baltimore, New Orleans, and many more. The MVA is typically focused on housing market metrics but this can vary from place to place. Depending on the needs of the city and data availability, other data-based systems may emphasize other demographic factors such as educational data, and crime statistics. That MVA has been used not only to target private investment but also to support the pursuit of other federal, state, and local funds, and even to design comprehensive development strategies. In 2005, Baltimore used the MVA to develop a Community Development Block Grant (CDBG) comprehensive plan and to guide the city’s capital budget plan. And in 2008 Baltimore used a Commercial Market Value Analysis (CMVA) to help develop understand its private and public sector strengths and weaknesses, and develop a comprehensive economic development strategy. In the image below, you will see an example of a hypothetical development and investment strategy breakdown based on data take from an MVA. There are several data-based tools that work to approach decision about investment and development strategy the way the MVA does. The question of how should fund be allocated to revitalize declining neighborhoods is not necessarily a question of if, but of where to start and how? Regardless of the methodology, it is important to never forget a place’s political context. This detail often impacts how a tool like the MVA is applied like in Richmond, Virginia. This model has allowed for communities to have an in depth neighborhood level understanding of the different markets at play, but ultimately still have to face the challenge of implementation and sustainability. Stephanie Watkins-Cruz is a dual-degree student in the Master of Public Administration and Master of City & Regional Planning programs at UNC-Chapel Hill and a Community Revitalization Fellow with the Development Finance Initiative. |

Published November 16, 2017 By CED Program Interns & Students

Of the many challenges in community revitalization, determining how to allocate limited funds is often at the top of the list. Should the dollars be split evenly by focusing on the very worst neighborhoods? Or should there be a form of targeting or some sort of custom-tailored solution? If the latter, how is the solution designed?

Of the many challenges in community revitalization, determining how to allocate limited funds is often at the top of the list. Should the dollars be split evenly by focusing on the very worst neighborhoods? Or should there be a form of targeting or some sort of custom-tailored solution? If the latter, how is the solution designed?

In 2001, the Reinvestment Fund designed a market value analysis system to help this investment decision making process. The Reinvestment Fund (TRF) is a Philadelphia based community development financial institution that brings together individual investors, banks, government officials, private foundations and faith-based and community organizations to invest in communities.

The market value analysis or MVA is a data-based tool designed by TRF to inform community revitalization and manage neighborhood change. Using spatial and statistical analysis, it identifies and characterizes local conditions throughout a specific locality and creates a typology or index of residential real estate markets. In Philadelphia for example, the MVA categorizes block groups as “regional choice/high value”, “steady”, “transitional”, or “distressed”.

The tool ultimately allows for stakeholders to have a common understanding of the market types within a locality that would allow for public, nonprofit and community organizations to engage accordingly and move towards the creation of coordinated community investment and strategic service delivery. Every single MVA is unique but consistently includes:

- Median and variability of housing sale prices

- Housing and land vacancy

- Mortgage foreclosures as a percentage of units (or sales)

- Rate of owner occupancy

- Presence of commercial land uses

- Share of the rental stock that receives a subsidy

- Density

The tool analyzes conditions at the community and the block group level, and can be used to both highlight market challenges as well as the nodes of strength in order to inform investment strategies. This type of data-based analysis has been done several places across the country such as Philadelphia, Baltimore, New Orleans, and many more. The MVA is typically focused on housing market metrics but this can vary from place to place. Depending on the needs of the city and data availability, other data-based systems may emphasize other demographic factors such as educational data, and crime statistics.

That MVA has been used not only to target private investment but also to support the pursuit of other federal, state, and local funds, and even to design comprehensive development strategies.

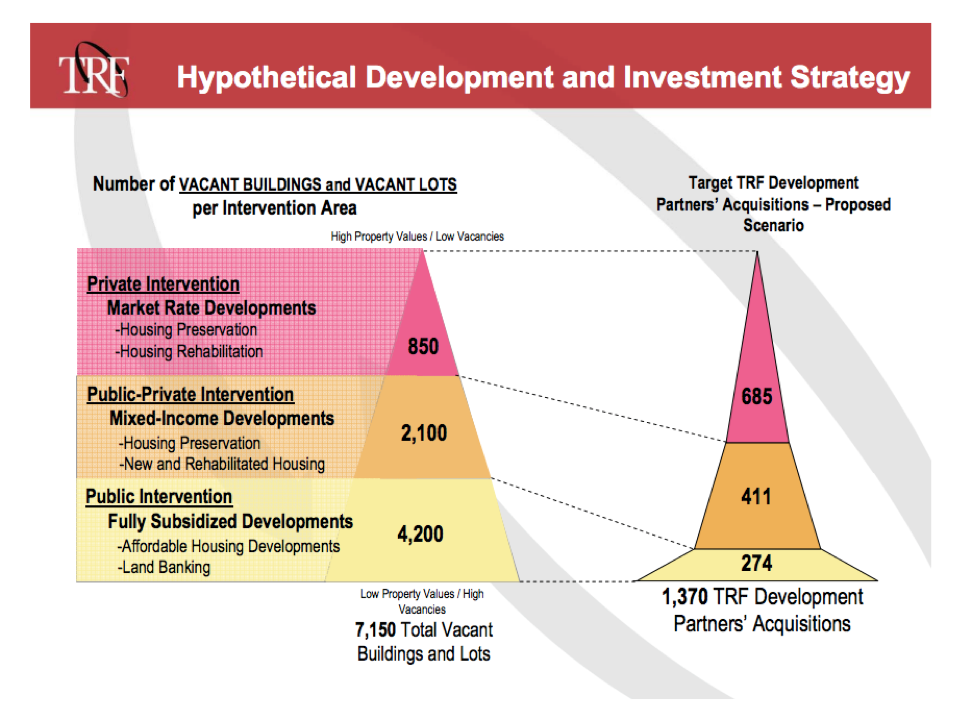

In 2005, Baltimore used the MVA to develop a Community Development Block Grant (CDBG) comprehensive plan and to guide the city’s capital budget plan. And in 2008 Baltimore used a Commercial Market Value Analysis (CMVA) to help develop understand its private and public sector strengths and weaknesses, and develop a comprehensive economic development strategy. In the image below, you will see an example of a hypothetical development and investment strategy breakdown based on data take from an MVA.

There are several data-based tools that work to approach decision about investment and development strategy the way the MVA does. The question of how should fund be allocated to revitalize declining neighborhoods is not necessarily a question of if, but of where to start and how? Regardless of the methodology, it is important to never forget a place’s political context. This detail often impacts how a tool like the MVA is applied like in Richmond, Virginia. This model has allowed for communities to have an in depth neighborhood level understanding of the different markets at play, but ultimately still have to face the challenge of implementation and sustainability.

Stephanie Watkins-Cruz is a dual-degree student in the Master of Public Administration and Master of City & Regional Planning programs at UNC-Chapel Hill and a Community Revitalization Fellow with the Development Finance Initiative.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.