This blog post is part of a regular series on recent trends in private real estate financing. These posts are meant to inform local governments about current conditions facing private developers and real estate development projects in their communities.

This blog post is part of a regular series on recent trends in private real estate financing. These posts are meant to inform local governments about current conditions facing private developers and real estate development projects in their communities.

Interest rates and lending for development

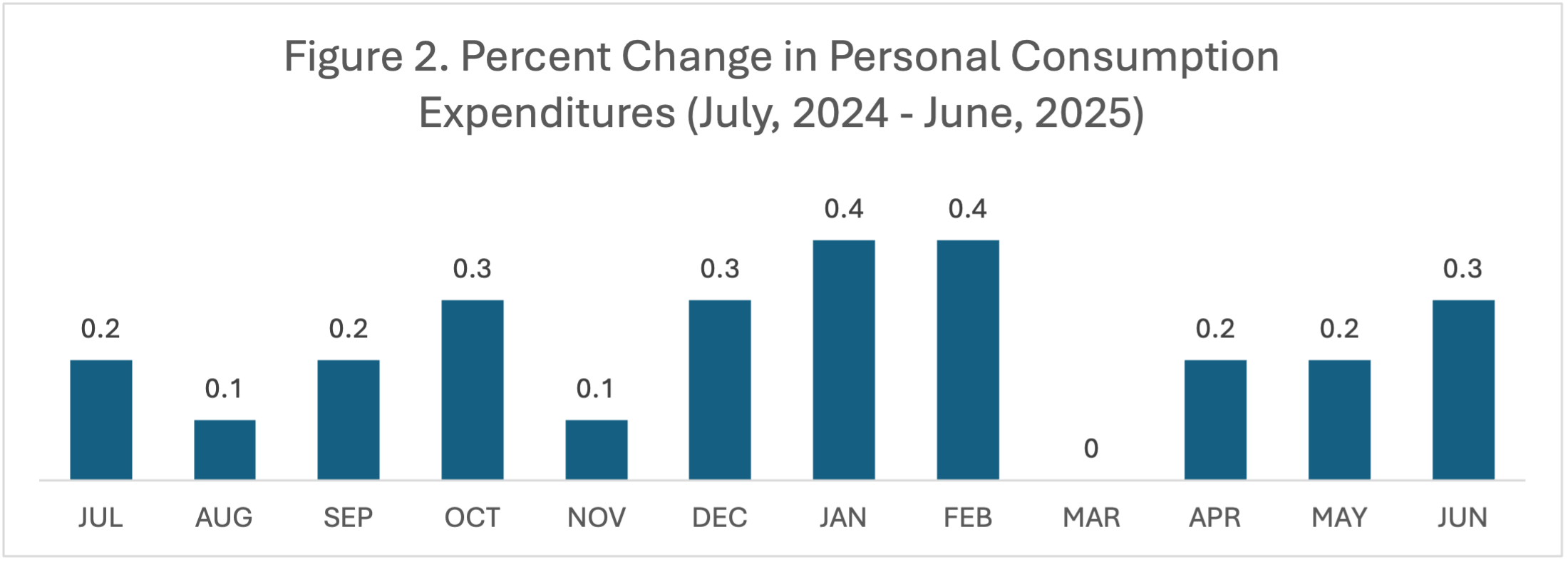

The federal funds rate held steady through Q2 at around 4.3% while the 10-Year fluctuated between 4.0% and 4.5% during the quarter.

Source: St. Louis Federal Reserve

Source: St. Louis Federal Reserve

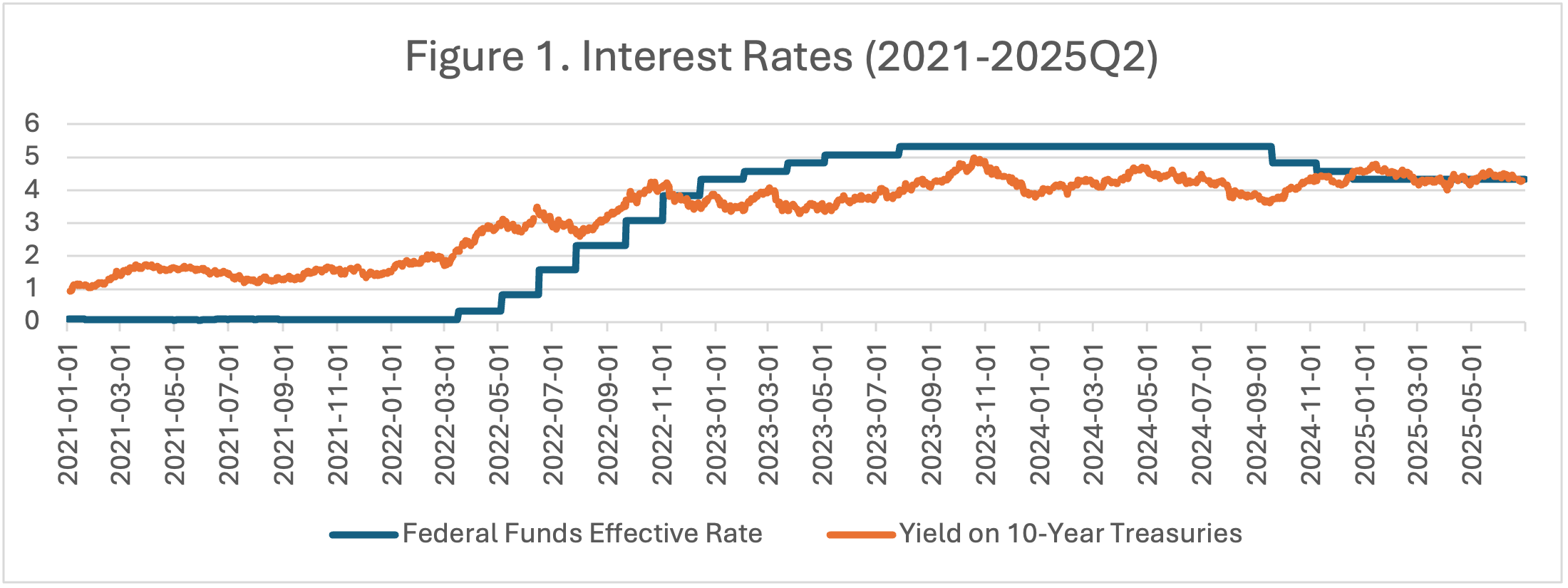

The Federal Reserve has been reluctant to cut rates due to persistent inflation and the uncertain impacts of new tariffs on inflation. Personal Consumption Expenditures grew 0.7% in Q2 and 2.7% since last June, compared to a target of 2.0% or 0.5% per quarter. See Figure 2. As of the writing of this post, the Federal Reserve lowered the target range for the federal funds rate by a quarter of a percentage point to 4.00% – 4.25% due to slowing job growth.

Source: Bureau of Economic Analysis

While rates are about 100 basis points lower than last year, Commercial Mortgage Backed Securities (CMBS) originations continued to decline in Q2 with just 438 originations in Q2 compared to 632 in Q1 (-31%). Office and retail originations saw a steeper decline at -43% and -48% respectively while multifamily originations declined by 22%. Compared to Q2 of last year, originations are down 58% with the most significant change happening in multifamily lending (-63%).

Construction Costs

The Producer Price Index (PPI) is reported by the U.S. Bureau of Labor Statistics and measures price changes from the perspective of the seller. The PPI for construction materials has fluctuated but is down to 339 from a high of around 353 in May, 2022. (U.S. Bureau of Labor Statistics). Despite the slight decrease, this still represents a 43% increase from pre-pandemic levels. Developers are also unsure about the impacts of new tariffs on construction costs and are reconsidering supply chains and the sourcing of materials to mitigate any potential negative impacts.

Developer Sentiment

With interest rates slowly coming down and construction prices stabilizing, developer confidence has continued to increase. According to one survey of the nation’s 30 leading apartment developers conducted by the National Multifamily Housing Council, developers reporting delays in construction starts dropped sharply this quarter from 93% to 70%. The availability of construction financing as a reason for construction delays dropped from 32% to 28% since last quarter and is down from 46% a year ago. Similarly, project feasibility as a reason for construction delays is down to 57% from 67% last quarter and 77% a year ago.

The uncertain impact of tariffs is reportedly a cause for concern among developers. Economic uncertainty as a reason for construction delays has risen from 67% to 71% since last quarter. According to the National Association of Home Builders Chairman Buddy Hughes, “The recent dip in mortgage rates may have pushed some buyers off the fence in March, helping builders with sales activity. At the same time, builders have expressed growing uncertainty over market conditions as tariffs have increased price volatility for building materials at a time when the industry continues to grapple with labor shortages and a lack of buildable lots.”

Continued Struggles for the Office Market

While CMBS delinquencies have risen across product types, office delinquencies remain the highest and continue to rise following the pandemic and shifting workplaces. According to Trepp data, overall delinquencies rose from 5.35% to 7.13% in the past year. Office delinquencies grew to a record-high of 11.08%.

In North Carolina, office transactions continue to become rarer and are down in all major cities from last year. The office buildings that are selling are doing so at huge discounts. For example, 525 N Tyron Street in Charlotte, a 400,000+ square foot (SF) office, sold in May for 25% of assessed value, while SouthCourt, a 140,000 SF office in Durham, sold for half of its 2020 sale price.

Tax Credits

Low Income Housing Tax Credit (LIHTC) pricing has continued to decrease slowly. Credits are currently selling for $0.85, down from $0.87 last year. The 2025 Reconciliation Bill (the “Bill”) was signed into law on July 4, 2025 and includes a handful of important changes to LIHTC financing which are expected to impact pricing. First, the “financed-by” test for tax-exempt bonds decreased from 50% to 25%, meaning that projects using 4% LIHTC only need 25% of their total costs to be financed by tax-exempt bonds. This will increase the number of 4% LIHTC deals while creating an additional gap in each project that will need to be filled by other sources. Second, the Bill increased 9% LIHTC allocations by 12%, again increasing the number of tax credits in the market. Both changes are expected to put downward pressure on LIHTC pricing, which means that developers of affordable housing will receive less upfront equity from tax credit investors in their projects. Less upfront equity translates to larger gaps in financing for LIHTC projects. Finally, the Bill makes the 100% bonus depreciation permanent which will increase investors’ post-tax returns. It will be important to watch LIHTC pricing as projects begin to get financed under the new law.

Clark Ricciardelli is an Analyst with the School of Government’s Development Finance Initiative.