|

|

Student Corner: Does affordable housing negatively impact nearby property values?By CED Program Interns & StudentsPublished January 26, 2017

Based on available literature, negative perceptions of affordable housing potentially outweigh research suggesting that affordable housing does not negatively impact property values. This blog post will dive into some of these academic studies to better understand the monetary and social facets of affordable housing and its impact. Public Perception of Affordable Housing

The perception of affordable housing was also documented in a study of landlords’ perceptions of the Housing Choice Voucher Program, also known as Section 8. In this study, the author, through interviews, uncovered four major themes:

Does affordable housing negatively impact property values? Despite negative perceptions of affordable housing noted above, there is research to suggest that affordable housing does not negatively impact property values. Mai Nguyen, Associate Professor at UNC-Chapel Hill in the Department of City & Regional Planning, conducted a literature review of quantitative studies concluding with the following findings:

The picture that has been painted thus far indicates that affordable housing at worst has a minimal negative impact on nearby property values. In another study, focusing on low income housing tax credit developments, the authors noted significant spillover effects of LIHTC developments in Charlotte and Cleveland. In Charlotte, there was a high turnover rate in areas after the completion of a LIHTC development particularly in higher-income areas and a decrease in property values of nearby housing. In Cleveland, higher turnover rates were seen but since many were located in already depressed neighborhood housing, increased turnover did not negatively impact property values.  So what can local governments do to address the negative perception? In addressing similar concerns of the negative perception of affordable housing, Beldon Russonello Strategists recommended that Chicago and Illinois take steps to minimize negative perceptions. Some of their steps include:

This blog post is not intended to be a literature review but provide a glance of what those in academia have to say on the impact of affordable housing on property values. Generally, there seems to be more evidence indicating that affordable housing will not result in a decrease of property values nearby; however, a negative perception of affordable housing only adds to the challenge of constructing affordable housing. Omar Kashef is a third-year graduate student seeking a dual-degree in Public Administration and Information Science and is currently a Fellow with the Development Finance Initiative. |

Published January 26, 2017 By CED Program Interns & Students

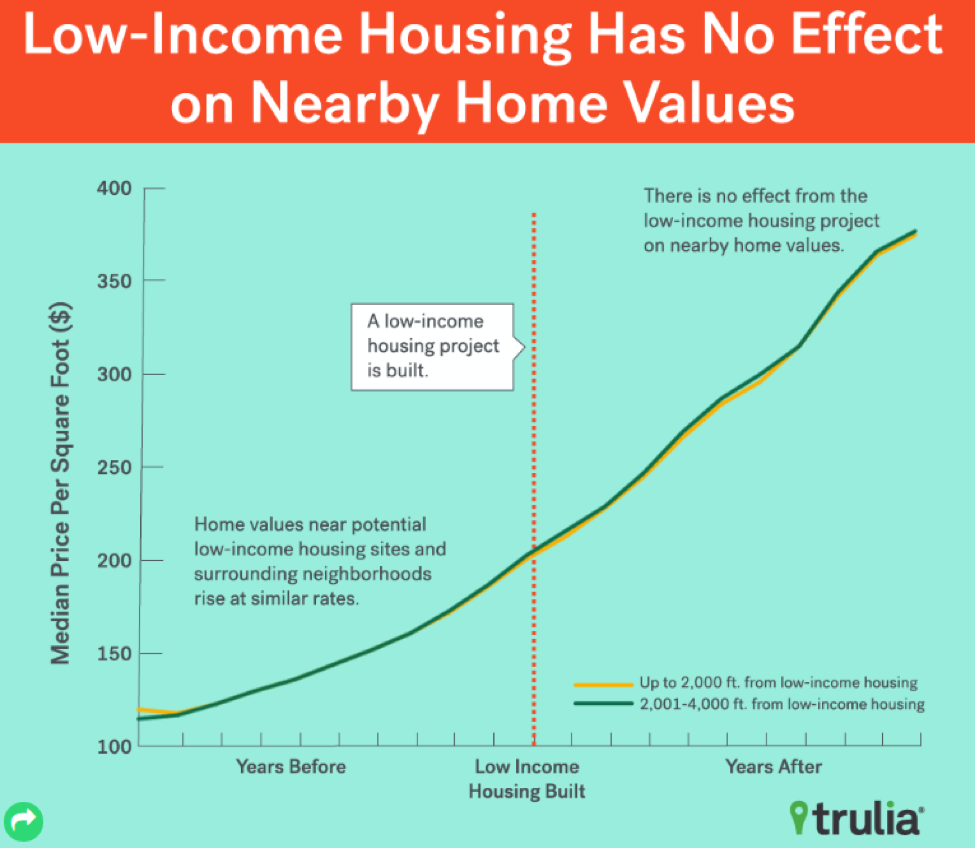

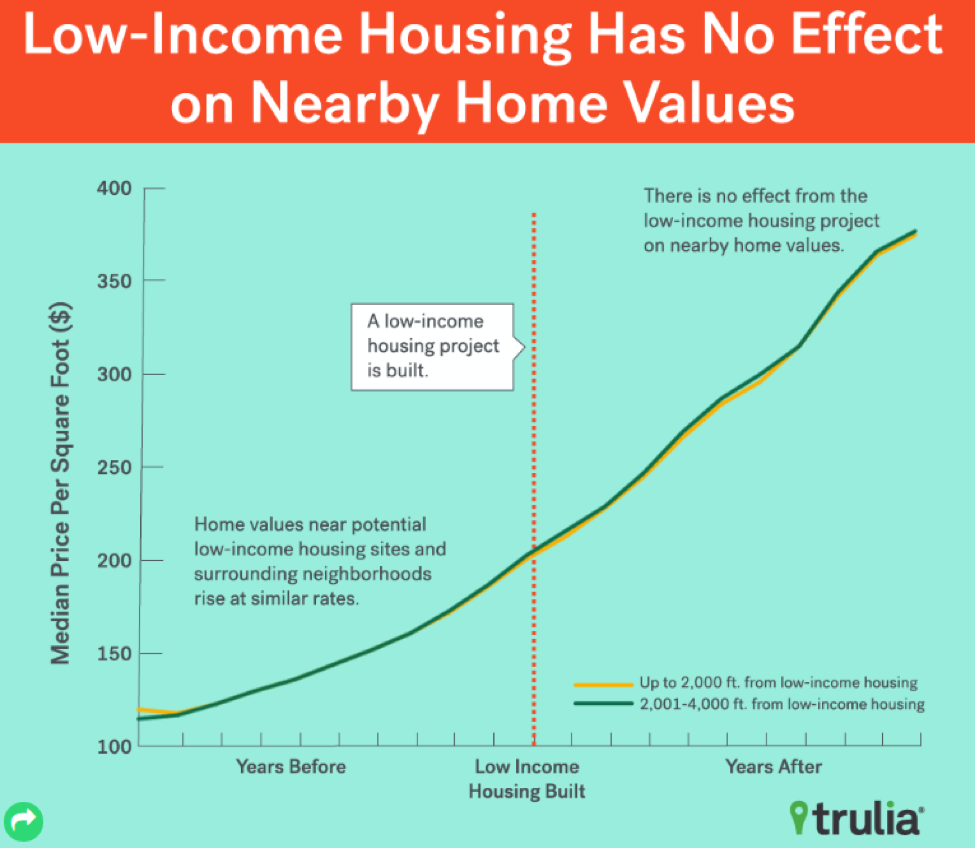

Despite public perceptions of affordable housing negatively impacting nearby property values, there is evidence to suggest that the impact is minimal if at all. Trulia, an online residential real estate site, recently conducted a study indicating that low-income housing tax credit (read more on LIHTC here) projects have no impact on the value of nearby properties. According to Trulia’s study, there was no significant effect from 1996 to 2006 on home values located near a LIHTC project. Trulia studied 20 markets across the country and of the 20, there was a negative impact in only 2 cities, Boston and Cambridge. There was drop of near $20 per square foot in housing prices; however, this was explained by quick bursts in the construction of affordable housing. In Denver, there was actually an $7 per square foot increase in value.

Despite public perceptions of affordable housing negatively impacting nearby property values, there is evidence to suggest that the impact is minimal if at all. Trulia, an online residential real estate site, recently conducted a study indicating that low-income housing tax credit (read more on LIHTC here) projects have no impact on the value of nearby properties. According to Trulia’s study, there was no significant effect from 1996 to 2006 on home values located near a LIHTC project. Trulia studied 20 markets across the country and of the 20, there was a negative impact in only 2 cities, Boston and Cambridge. There was drop of near $20 per square foot in housing prices; however, this was explained by quick bursts in the construction of affordable housing. In Denver, there was actually an $7 per square foot increase in value.

Based on available literature, negative perceptions of affordable housing potentially outweigh research suggesting that affordable housing does not negatively impact property values. This blog post will dive into some of these academic studies to better understand the monetary and social facets of affordable housing and its impact.

Public Perception of Affordable Housing

- Rosie Tighe, Assistant Professor at Appalachian State University in the Department of Geography and Planning, conducted a literature review to assess the public opinion of affordable housing. NIMBY, or “not in my backyard” opposition towards affordable housing occurs even after a project clears the major financial barriers towards the development of affordable housing. The major barriers to implementing affordable housing policies designed to provide housing for those that cannot afford to rent or buy at market rate also includes high land costs, inflexible zoning codes, and inadequate financing for additional development. Some of the major findings of the literature review are as follow:

- The negative perception of the risk associated with affordable housing is powerful even if negated by research. This is apparent in surveys indicating that there is general support for affordable housing but as housing policies become more concrete, people perceive greater risk than in that then more value-laden statements about the need for affordable housing

- Once affordable housing is actually constructed, negative perceptions of affordable housing decrease

The perception of affordable housing was also documented in a study of landlords’ perceptions of the Housing Choice Voucher Program, also known as Section 8. In this study, the author, through interviews, uncovered four major themes:

- Tenant Stigma: tenants with vouchers are perceived as more likely to have low credit scores, damage property, and use drugs.

- Money: tenants are not paying their portion of the rent and the fair market rent is lower than market value

- Inspections: homes cannot be inspected until they are empty; frequent delays; inconsistent inspections

- Administrative Burden: too much paperwork; lack of electronic communication

Does affordable housing negatively impact property values?

Despite negative perceptions of affordable housing noted above, there is research to suggest that affordable housing does not negatively impact property values. Mai Nguyen, Associate Professor at UNC-Chapel Hill in the Department of City & Regional Planning, conducted a literature review of quantitative studies concluding with the following findings:

- Affordable housing is not as significant as other variables influencing property values

- The build quality of affordable housing in comparison to surrounding housing can impact property values nearby

- When affordable housing is clustered there is a greater potential for decreased property values nearby

The picture that has been painted thus far indicates that affordable housing at worst has a minimal negative impact on nearby property values. In another study, focusing on low income housing tax credit developments, the authors noted significant spillover effects of LIHTC developments in Charlotte and Cleveland. In Charlotte, there was a high turnover rate in areas after the completion of a LIHTC development particularly in higher-income areas and a decrease in property values of nearby housing. In Cleveland, higher turnover rates were seen but since many were located in already depressed neighborhood housing, increased turnover did not negatively impact property values.

So what can local governments do to address the negative perception? In addressing similar concerns of the negative perception of affordable housing, Beldon Russonello Strategists recommended that Chicago and Illinois take steps to minimize negative perceptions. Some of their steps include:

- Give the lack of affordable housing publicity

- Encourage a broad view of affordable housing that includes differing area median income levels

- Put a human voice on the issue to invoke responsibility

- Recognize different values and needs when addressing different audiences

This blog post is not intended to be a literature review but provide a glance of what those in academia have to say on the impact of affordable housing on property values. Generally, there seems to be more evidence indicating that affordable housing will not result in a decrease of property values nearby; however, a negative perception of affordable housing only adds to the challenge of constructing affordable housing.

Omar Kashef is a third-year graduate student seeking a dual-degree in Public Administration and Information Science and is currently a Fellow with the Development Finance Initiative.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.