|

|

Student Corner: Community Ownership as a Tool for Preservation and Wealth CreationBy CED Program Interns & StudentsPublished September 9, 2021

As the nation prepares for greater investment in infrastructure and real estate development, it is critical to prioritize innovative models that enable more inclusive, local ownership opportunities that promote residential and business preservation as a wealth creation strategy. One of the ways communities can address this is through implementing Community Ownership models. This post will discuss what Community Ownership is, how it works, and a variety of existing case studies. What is Community Ownership? A recent Brookings article, Helping Residents ‘Buy Back the Block’ with American Rescue Plan Funds, points to community ownership models as a way to steward community assets in an effort to cultivate shared and individual wealth among local residents. Community Ownership enables residents with limited financial resources and partnering organizations to purchase and develop or redevelop land or buildings in their communities, and maintain wealth within. Research conducted by the Strong, Prosperous, And Resilient Communities Challenge (SPARCC) has found several key benefits of this model. Primarily, it is a means of community preservation–an opportunity to retain legacy businesses and resident populations through the investment in new community assets. Ownership enables a deepening of the social fabric of the community through the participation of local organizations, increased economic and leadership participation among residents, and a sense of pride and agency over the changes in an area. For example, local residents gain shared control over the current and future tenant makeup of both residential and commercial properties. There are many individual advantages as well, including access to lower rent, homeownership, and energy costs, as well as the expectation of returns on shares of rising asset values. How do Community Ownership models work? Community Ownership models can take on a variety of legal forms in order to be leveraged for single-family or multi-family residential, commercial properties, operating businesses, accessory dwelling units, or community resources, like a garden or park. Ownership structures typically begin with a community land trust—a tool that has long been leveraged by town governments and private organizations to stabilize housing affordability and access to ownership, where property values have outpaced existing capacity. However, land trusts for the use of commercial properties require greater nuance, so as to not stifle the profit potential of the competing market supply. In the case of commercial properties, community land trusts (CLTs) can serve as a transitional vehicle whereby residents or businesses (directly or collectively) can buy the property from the trust over time—a necessary step for acquisition in fast-paced real estate markets. Case Studies of Community Ownership Models The following four Community Ownership case studies each include commercial real estate in their portfolios, yet reveal the flexibility of this model to accommodate scale, access to financial resources, and partnership structures. Los Angeles Community Ownership Real Estate (LA CORE) Co-Founder of LA CORE, Marco Covarrubias, shared in a recent webinar with SPARCC about Boyle Heights how small businesses are often the first to be displaced when outside investors begin to encroach upon lower-income community markets, particularly because these businesses are subject to month-to-month lease schedules. Often the vulnerabilities faced by existing businesses are posited as evidence of opportunity for higher capacity investors to jump into areas “poised for tremendous growth.” LA CORE was specifically created to move commercial real estate out of the speculative market and into the community stewardship of local nonprofits who can guide its tenancy and use to best serve local residents,” as stated by fellow Co-Founder, Tom DeSimone in a recent LISC panel. LA CORE was initially launched by economic development corporation, Genesis LA, in partnership with co-owners, Inclusive Action for the City (IAC), East LA Community Corporation (ELACC), and Little Tokyo Service Center (LTSC). To date, LA CORE has acquired 5 commercial properties with 19 leasable units, for a total of $10 million. Rehabilitation construction has been completed for 3 of the 5 properties and 12 of the units are already occupied. To finance this fund, Genesis LA was first awarded a $10 million New Market Tax Credit (NMTC) allocation in 2016. Philanthropic and grant funding amounted to $1.4MM (contributors including SPARCC, The California Endowment, Weingart, and other smaller funders), along with $2.75MM raised in PRIs. These investments were repackaged by a Leverage Lender (IAC and ELACC), along with a CDFI loan of roughly $2.9MM from Genesis LA, amounting to a $7MM loan. Finally, JP Morgan Chase made a NMTC equity investment of $3MM to complete the capital stack. LISC’s Community Asset Transition Fund (CAT Fund) Another neighborhood investment model that launched this year is LISC’s CAT Fund, with over $30 million to be deployed towards community wealth building opportunities–such as the provision of funds for acquisition and development of properties identified as being “at risk of market conversion” in the areas of Minneapolis most impacted by the civil unrest following the death of George Floyd in 2020. This fund is backed by investments from LISC, Hennepin County, and contributions from JPMC, the Bush Foundation, and the McKnight Foundation. To successfully execute this initiative, the CAT Fund relies on acquisition and development partners, such as Land Bank Twin Cities, City of Lakes Commercial Land Trust, and other CDCs, along with many community organization partners to cultivate residential trust and awareness. Mercy Corp’s Community Investment Trust At a much smaller scale, a residential cooperative has been successfully deployed by Mercy Corp’s Community Investment Trust, which enabled residents in Southeast Portland, Oregon to collectively purchase a 29,000 square-foot commercial strip with 26-30 tenants in their neighborhood. This was accomplished by 500 local residents contributing between $10-$100 micro-investments. Shareholders are given the power to vote on any changes made to the property and receive a minimum of 2% earned annual dividend, with a goal of buying out the property from the Trust in time. Neighborhood Investment Company (NICO) Perhaps a more well-known ownership model is the growing trend of real estate investment trusts (REITs), which serve to democratize the real estate market by facilitating smaller entry investment opportunities. Some REITs are publicly traded, such as Highwood Properties REIT that recently purchased the Raleigh Wells Fargo building in April, 2021, and draw in investors across geographies and income levels. Privately held REITs, on the other hand, tend to have high minimum income and net worth requirements, given that they are more illiquid and, thus, less immune to the ebb and flow of the market. That said, private REITs also present unique benefits for community minded investors and have proven to be feasible with moderate to micro investment types that are accessible to the participation of lower-income residents. The Neighborhood Investment Company (NICO) is an example of a smaller private REIT (or “neighborhood REIT”) focused on the neighborhood of Echo Park, California—an area highly impacted by the speculative market surrounding Los Angeles. NICO purchases older buildings and renovates and updates for environmental sustainability, in order to present rent-stabilized multi-family and commercial buildings for long-term residents of the neighborhood. Shareholders, near and far, buy into the portfolio with a minimum of 10 shares, currently $95, and receive quarterly dividends that can be cashed out or reinvested. As described in their Neighborhood Impact Report for 2020, NICO gained 398 new shareholders (225 of whom are residents of Los Angeles and 128 of whom earn under $50,000/year), and is currently is a housing provider for approximately 120 residents and 4 small businesses across our 3 rent-stabilized buildings in Echo Park. Amidst the COVID-19 pandemic, all of the commercial tenants remained in business and residential residents received roughly $170,000 in Rent Assistance Program funding (22% of whom have lived in the neighborhood for at least five years). Moreover, their investment in a grey water system saved an estimated 48,000 gallons of water over the year. Considering community ownership? Community Ownership has a growing track record for its ability to preserve community assets and protect against the growing threat of displacement. If an entity is interested in implementing a community ownership model, SPARCC and its partner organizations have created a resource guide, which includes articles, case studies, and educational materials to support the awareness and replication of this model. In addition, the School of Government’s Development Finance Initiative has experience with land trust and community investment models and can offer technical assistance to local governments and their charitable partners. Mary Elizabeth Russell is candidate for the Master of Business Administration at Kenan-Flagler and a Master of City & Regional Planning candidate at UNC-Chapel Hill. She is also a Community Revitalization Fellow with the Development Finance Initiative. |

Published September 9, 2021 By CED Program Interns & Students

As the nation prepares for greater investment in infrastructure and real estate development, it is critical to prioritize innovative models that enable more inclusive, local ownership opportunities that promote residential and business preservation as a wealth creation strategy. One of the ways communities can address this is through implementing Community Ownership models. This post will discuss what Community Ownership is, how it works, and a variety of existing case studies.

What is Community Ownership?

A recent Brookings article, Helping Residents ‘Buy Back the Block’ with American Rescue Plan Funds, points to community ownership models as a way to steward community assets in an effort to cultivate shared and individual wealth among local residents. Community Ownership enables residents with limited financial resources and partnering organizations to purchase and develop or redevelop land or buildings in their communities, and maintain wealth within.

Research conducted by the Strong, Prosperous, And Resilient Communities Challenge (SPARCC) has found several key benefits of this model. Primarily, it is a means of community preservation–an opportunity to retain legacy businesses and resident populations through the investment in new community assets. Ownership enables a deepening of the social fabric of the community through the participation of local organizations, increased economic and leadership participation among residents, and a sense of pride and agency over the changes in an area. For example, local residents gain shared control over the current and future tenant makeup of both residential and commercial properties. There are many individual advantages as well, including access to lower rent, homeownership, and energy costs, as well as the expectation of returns on shares of rising asset values.

How do Community Ownership models work?

Community Ownership models can take on a variety of legal forms in order to be leveraged for single-family or multi-family residential, commercial properties, operating businesses, accessory dwelling units, or community resources, like a garden or park.

Ownership structures typically begin with a community land trust—a tool that has long been leveraged by town governments and private organizations to stabilize housing affordability and access to ownership, where property values have outpaced existing capacity. However, land trusts for the use of commercial properties require greater nuance, so as to not stifle the profit potential of the competing market supply.

In the case of commercial properties, community land trusts (CLTs) can serve as a transitional vehicle whereby residents or businesses (directly or collectively) can buy the property from the trust over time—a necessary step for acquisition in fast-paced real estate markets.

Case Studies of Community Ownership Models

The following four Community Ownership case studies each include commercial real estate in their portfolios, yet reveal the flexibility of this model to accommodate scale, access to financial resources, and partnership structures.

Los Angeles Community Ownership Real Estate (LA CORE)

Co-Founder of LA CORE, Marco Covarrubias, shared in a recent webinar with SPARCC about Boyle Heights how small businesses are often the first to be displaced when outside investors begin to encroach upon lower-income community markets, particularly because these businesses are subject to month-to-month lease schedules. Often the vulnerabilities faced by existing businesses are posited as evidence of opportunity for higher capacity investors to jump into areas “poised for tremendous growth.” LA CORE was specifically created to move commercial real estate out of the speculative market and into the community stewardship of local nonprofits who can guide its tenancy and use to best serve local residents,” as stated by fellow Co-Founder, Tom DeSimone in a recent LISC panel.

LA CORE was initially launched by economic development corporation, Genesis LA, in partnership with co-owners, Inclusive Action for the City (IAC), East LA Community Corporation (ELACC), and Little Tokyo Service Center (LTSC). To date, LA CORE has acquired 5 commercial properties with 19 leasable units, for a total of $10 million. Rehabilitation construction has been completed for 3 of the 5 properties and 12 of the units are already occupied.

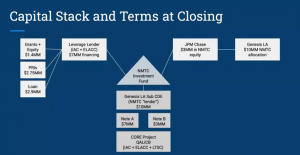

To finance this fund, Genesis LA was first awarded a $10 million New Market Tax Credit (NMTC) allocation in 2016. Philanthropic and grant funding amounted to $1.4MM (contributors including SPARCC, The California Endowment, Weingart, and other smaller funders), along with $2.75MM raised in PRIs. These investments were repackaged by a Leverage Lender (IAC and ELACC), along with a CDFI loan of roughly $2.9MM from Genesis LA, amounting to a $7MM loan. Finally, JP Morgan Chase made a NMTC equity investment of $3MM to complete the capital stack.

LISC’s Community Asset Transition Fund (CAT Fund)

Another neighborhood investment model that launched this year is LISC’s CAT Fund, with over $30 million to be deployed towards community wealth building opportunities–such as the provision of funds for acquisition and development of properties identified as being “at risk of market conversion” in the areas of Minneapolis most impacted by the civil unrest following the death of George Floyd in 2020.

This fund is backed by investments from LISC, Hennepin County, and contributions from JPMC, the Bush Foundation, and the McKnight Foundation. To successfully execute this initiative, the CAT Fund relies on acquisition and development partners, such as Land Bank Twin Cities, City of Lakes Commercial Land Trust, and other CDCs, along with many community organization partners to cultivate residential trust and awareness.

Mercy Corp’s Community Investment Trust

At a much smaller scale, a residential cooperative has been successfully deployed by Mercy Corp’s Community Investment Trust, which enabled residents in Southeast Portland, Oregon to collectively purchase a 29,000 square-foot commercial strip with 26-30 tenants in their neighborhood. This was accomplished by 500 local residents contributing between $10-$100 micro-investments. Shareholders are given the power to vote on any changes made to the property and receive a minimum of 2% earned annual dividend, with a goal of buying out the property from the Trust in time.

Neighborhood Investment Company (NICO)

Perhaps a more well-known ownership model is the growing trend of real estate investment trusts (REITs), which serve to democratize the real estate market by facilitating smaller entry investment opportunities. Some REITs are publicly traded, such as Highwood Properties REIT that recently purchased the Raleigh Wells Fargo building in April, 2021, and draw in investors across geographies and income levels. Privately held REITs, on the other hand, tend to have high minimum income and net worth requirements, given that they are more illiquid and, thus, less immune to the ebb and flow of the market. That said, private REITs also present unique benefits for community minded investors and have proven to be feasible with moderate to micro investment types that are accessible to the participation of lower-income residents.

The Neighborhood Investment Company (NICO) is an example of a smaller private REIT (or “neighborhood REIT”) focused on the neighborhood of Echo Park, California—an area highly impacted by the speculative market surrounding Los Angeles. NICO purchases older buildings and renovates and updates for environmental sustainability, in order to present rent-stabilized multi-family and commercial buildings for long-term residents of the neighborhood. Shareholders, near and far, buy into the portfolio with a minimum of 10 shares, currently $95, and receive quarterly dividends that can be cashed out or reinvested.

As described in their Neighborhood Impact Report for 2020, NICO gained 398 new shareholders (225 of whom are residents of Los Angeles and 128 of whom earn under $50,000/year), and is currently is a housing provider for approximately 120 residents and 4 small businesses across our 3 rent-stabilized buildings in Echo Park. Amidst the COVID-19 pandemic, all of the commercial tenants remained in business and residential residents received roughly $170,000 in Rent Assistance Program funding (22% of whom have lived in the neighborhood for at least five years). Moreover, their investment in a grey water system saved an estimated 48,000 gallons of water over the year.

Considering community ownership?

Community Ownership has a growing track record for its ability to preserve community assets and protect against the growing threat of displacement. If an entity is interested in implementing a community ownership model, SPARCC and its partner organizations have created a resource guide, which includes articles, case studies, and educational materials to support the awareness and replication of this model. In addition, the School of Government’s Development Finance Initiative has experience with land trust and community investment models and can offer technical assistance to local governments and their charitable partners.

Mary Elizabeth Russell is candidate for the Master of Business Administration at Kenan-Flagler and a Master of City & Regional Planning candidate at UNC-Chapel Hill. She is also a Community Revitalization Fellow with the Development Finance Initiative.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.