This blog post is part of a regular series on recent trends in private real estate financing. These posts are meant to inform local governments about current conditions facing private developers and real estate development projects in their communities.

Lending for real estate development projects

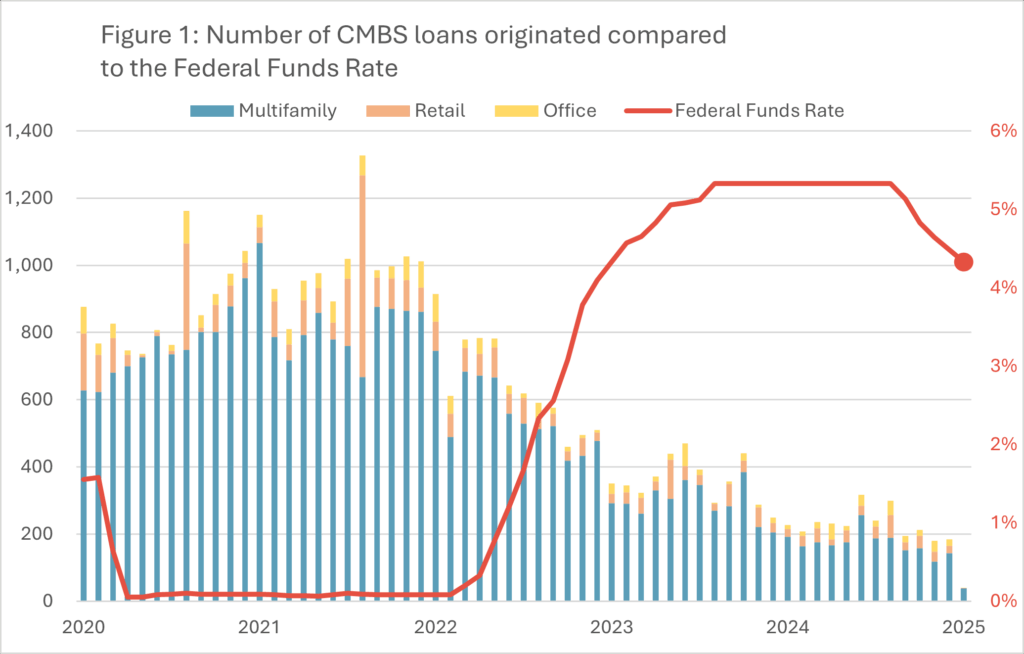

To recap, as inflation rose in 2022, the Federal Reserve voted to increase interest rates after a keeping them at near zero percent in response to the COVID-19 economic crisis. As rates rose, lending for real estate development projects slowed down as projects became more difficult to finance. Even after interest rates were cut again in September 2024, real estate development lending has not returned to pre-2024 levels. (Figure 1)

Developers continue to report challenges caused by high interest rates. For example, in September 2023, an affordable housing developer in Wilmington requested $1.25 million in additional gap funding from the city and county to help cover rising interest rate costs.

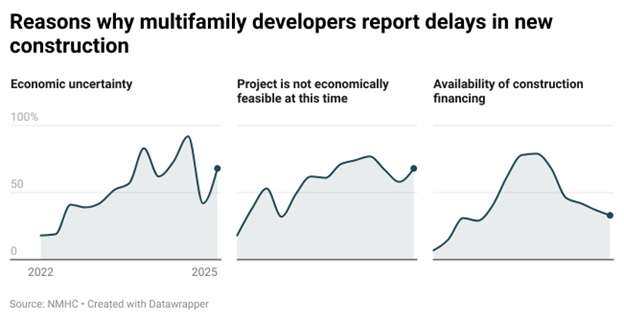

According to one survey of the nation’s 30 leading apartment developers conducted by the National Multifamily Housing Council, over half of developers continued to report delays in construction.[1] Of those surveyed, 68% responded that delays were because of economic uncertainty and feasibility of the project. For instance, Kane Realty – a commercial real estate development company – reported last December that future progress on the mixed-use “Downtown South” project in Raleigh is contingent on “interest rates going down”.

In March, the number of apartment builders that reported delays due to the availability of financing continued to drop from 79% to 33%, reflecting that lenders are more willing to lend than two years ago.

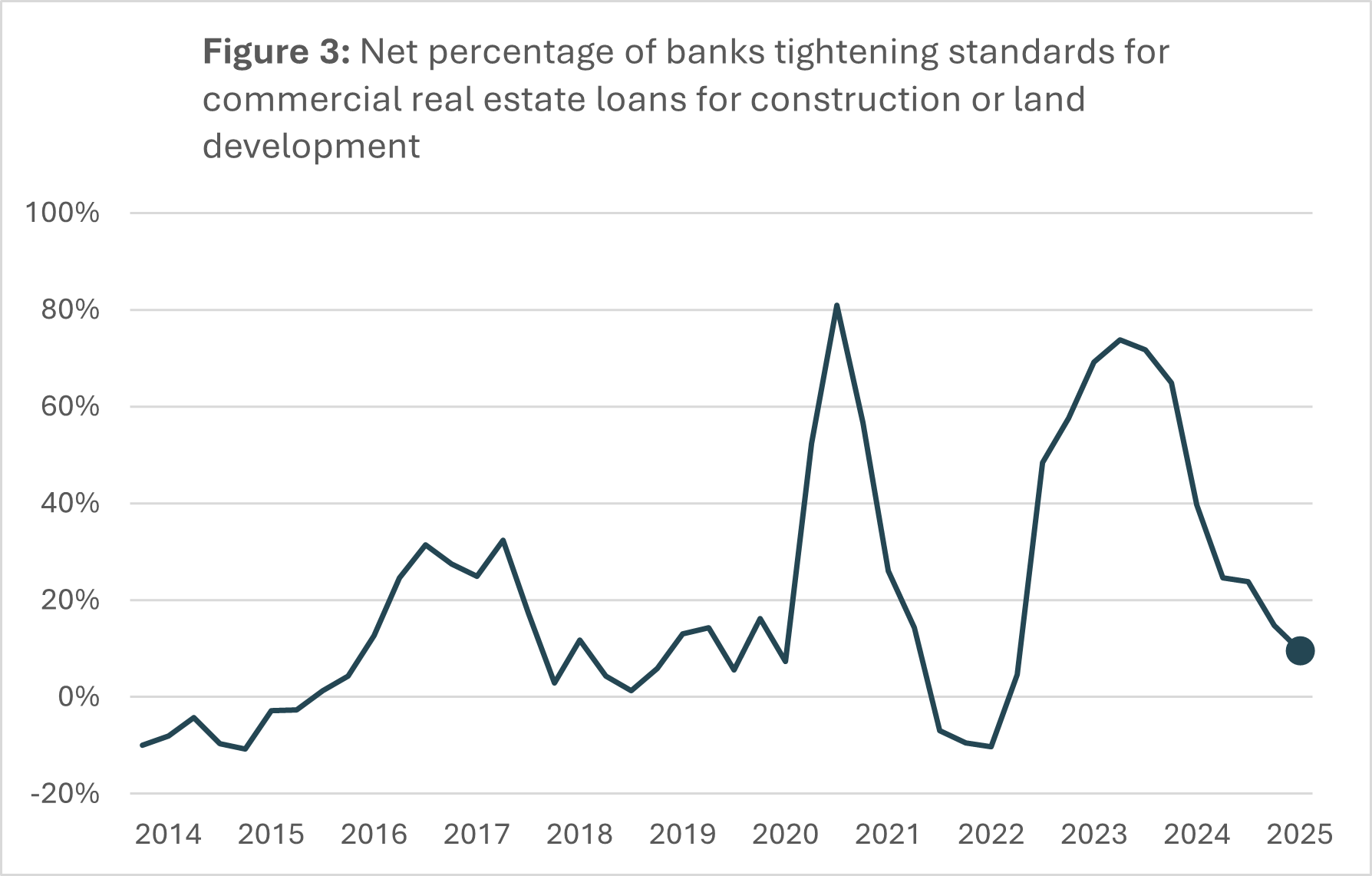

This trend is supported by other data showing that banks are beginning to loosen credit standards, making it easier for developers to borrow for new construction. Figure 3 shows survey response data from the Federal Reserve’s Senior Loan Officer Opinion Survey (or SLOOS). Survey responses indicate that just 10% of banks are tightening standards for commercial real estate loans used for construction or land development, compared to over 70% in 2023.

According to another survey conducted by the National Multifamily Housing Council, 45% of CEOs of apartment-related firms reported that now was a better time to borrow for multifamily housing compared to just 3% in July 2023.

Changes in construction costs

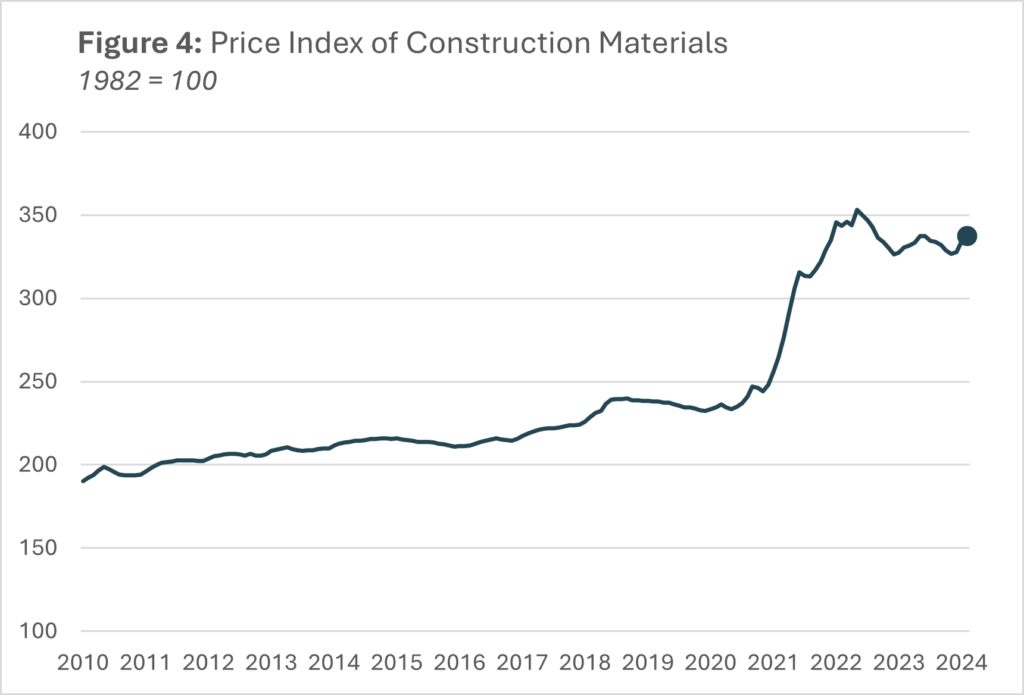

In addition to the availability of lending, the cost of building materials continues to be between 30% and 45% higher than pre-COVID prices. In January 2023, one construction company official told WBTV, “COVID really started really inflating prices for construction, for a lot of different materials and that was really the start of it, and now inflation after that has kept prices kind of high, so it’s been probably about 2-years now.” Even with recent reduced inflation, constructions costs have not declined to pre-COVID levels.[2] (Figure 4)

[1] Source: National Multifamily Housing Council. Quarterly Survey of Apartment Construction & Development Activity (September 2023). https://www.nmhc.org/research-insight/nmhc-construction-survey/2025/quarterly-survey-of-apartment-construction-development-activity-march-2025/

[2] St. Louis FRED Economic Data. Producer Price Index by Commodity: Special Indexes: Construction Materials. https://fred.stlouisfed.org/series/WPUSI012011