|

|

How buy-to-rent investors are changing North Carolina neighborhoodsBy Frank MuracaPublished November 12, 2020In 2018, nearly one in five “starter homes” – or houses priced at the bottom third of the local market – were bought by investors rather than prospective homeowners. While investors take many forms such as “flippers” or owners that turn properties into Airbnbs, a growing cohort of companies are reshaping neighborhoods by converting single-family homes into long-term rental properties. In October 2020, Invitation Homes Inc, the nation’s largest owner of single-family rental properties, announced that it would invest $1 billion towards expanding it’s 80,000-unit portfolio. Invitation Homes – and other large investors like it – operate as Real Estate Investment Trusts (REITs) that pull together funds from investors to acquire and often manage real estate. While REITs have been around for a long time and helped invest in commercial, hospitality, and industrial real estate, some of the country’s fastest growing REITs specialize in acquiring previously owner-occupied homes in single-family neighborhoods and converting them into rental properties. There are a few reasons why buy-to-rent REITs are expanding their operations, including economic and technological changes that make it easier for investors to acquire and manage thousands of properties across a metro area. Research shows that the ownership model grew in the early years following the Great Recession, when large numbers of low-income households lost their homes to foreclosure. Investors were able to convert single-family homes into rentals because of their low acquisition prices and growing demand as newly foreclosed homeowners converted to renters. One study estimated that over 75% of households that had lost their homes in foreclosure moved to single-family rentals. Additionally, a report from August 2020 predicted that demand for single-family rental properties will likely outpace supply over the next ten years, because Millennials reaching their 30s and 40s would likely prefer more spacious single-family homes over multi-family but may not have the savings to purchase their own home. These trends are significant for North Carolina communities because it demonstrates the growing impact financial entities have in shaping where and how people live at the neighborhood-level. This post explores which neighborhoods are most likely to attract buy-to-rent investors using a sample of approximately 8,800 properties owned by four nationally recognized companies: Invitation Homes, Progress Residential, Tricon, and American Homes 4 Rent. Because REITs are often challenging to identify in public tax parcel data, this analysis only looks at activity in Durham, Wake, and Mecklenburg Counties.[1] Of the properties identified, 60% were in Mecklenburg County, 36% were in Wake County, and 4% were in Durham. While research on investor activity in other parts of the country show increased investor activity in the early years following the Great Recession, these companies acquired the majority of their properties only in the past few years. Additionally, while acquisitions between 2013 and 2015 were concentrated in the Raleigh region, recent investments shifted to Charlotte.  As mentioned above, research shows that buy-to-rent investors were most active in communities with greater concentrations of foreclosed homes. We can use the sample of investor properties to show what kinds of neighborhoods tend to have higher concentrations of investment properties. Figure 2 shows Census Tracts where these investors own properties, with the x-axis showing the change in neighborhood homeownership rate between 2011 and 2018 and y-axis showing the percentage of housing units owned by investors. Of the 119 Census Tracts where REITs own more than one percent of housing units, 100 had declining homeownership rates, suggesting that investors have larger impacts on the supply of rental housing in neighborhoods with already decreasing homeownership rates.  What else do we know about these neighborhoods? Figure 3 shows that nearly 6,000 investor-owned properties are in Census Tracts where homeownership rates have decreased and are predominantly made up of households of color. This is significant because these neighborhoods were also most likely to be made up of Black and Hispanic homeowners who were impacted by the foreclosure crisis. Some news reports in communities such as Atlanta have shown how investors in neighborhoods with declining Black or Hispanic homeownership resort to predatory tactics to acquire properties from homeowners.  These numbers are relevant for North Carolina communities while considering responses to fallout from Covid-19. According to a recent story in the Wall Street Journals, buy-to-rent investors seek to acquire more properties over the next years. While some homes might be acquired following foreclosure, they also express interest in purchasing from cash-poor homeowners who face prolonged unemployment. As home prices have increased over the past, unemployed homeowners unable to pay mortgage payments may be more willing to sell to access needed equity. “A lot of people are house-rich but cash-poor,” one real-estate consultant told the Wall Street Journal. “If they bought in the last two or three years, even if they bought five months ago, they have equity.”  Buy-to-rent investors have a growing footprint in North Carolina neighborhoods. Tracking these trends is important for understanding how affordable homeownership opportunities are being affected by the growth of single-family rental properties. Finally, prolonged unemployment among low-income homeowners may exacerbate the conversion of affordable single-family homes into rental properties. [1] Investor-owned properties are often difficult to identify due to the many names under which an investor may own parcels. The properties in this analysis were identified using a combination searches by owner name and mailing addresses for corporate offices. In this sample, the four buy-to-rent investors own property under 215 unique names. |

Published November 12, 2020 By Frank Muraca

In 2018, nearly one in five “starter homes” – or houses priced at the bottom third of the local market – were bought by investors rather than prospective homeowners. While investors take many forms such as “flippers” or owners that turn properties into Airbnbs, a growing cohort of companies are reshaping neighborhoods by converting single-family homes into long-term rental properties.

In October 2020, Invitation Homes Inc, the nation’s largest owner of single-family rental properties, announced that it would invest $1 billion towards expanding it’s 80,000-unit portfolio. Invitation Homes – and other large investors like it – operate as Real Estate Investment Trusts (REITs) that pull together funds from investors to acquire and often manage real estate. While REITs have been around for a long time and helped invest in commercial, hospitality, and industrial real estate, some of the country’s fastest growing REITs specialize in acquiring previously owner-occupied homes in single-family neighborhoods and converting them into rental properties.

There are a few reasons why buy-to-rent REITs are expanding their operations, including economic and technological changes that make it easier for investors to acquire and manage thousands of properties across a metro area. Research shows that the ownership model grew in the early years following the Great Recession, when large numbers of low-income households lost their homes to foreclosure. Investors were able to convert single-family homes into rentals because of their low acquisition prices and growing demand as newly foreclosed homeowners converted to renters. One study estimated that over 75% of households that had lost their homes in foreclosure moved to single-family rentals. Additionally, a report from August 2020 predicted that demand for single-family rental properties will likely outpace supply over the next ten years, because Millennials reaching their 30s and 40s would likely prefer more spacious single-family homes over multi-family but may not have the savings to purchase their own home.

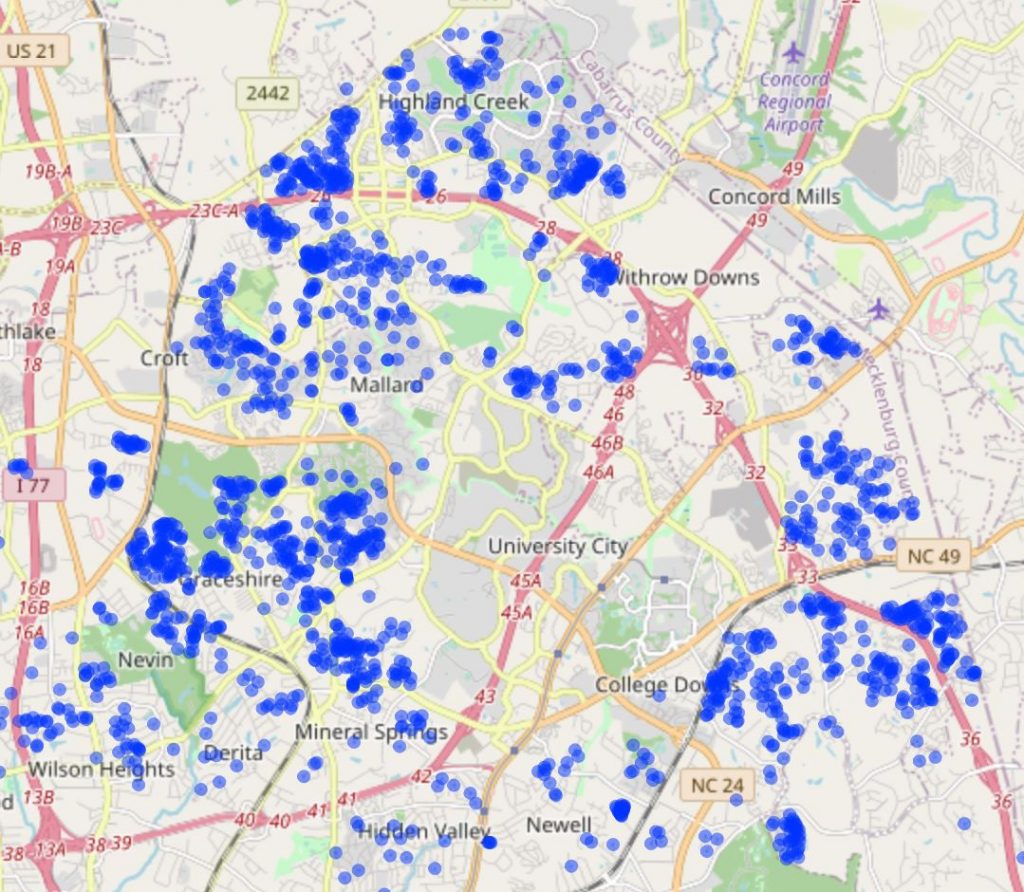

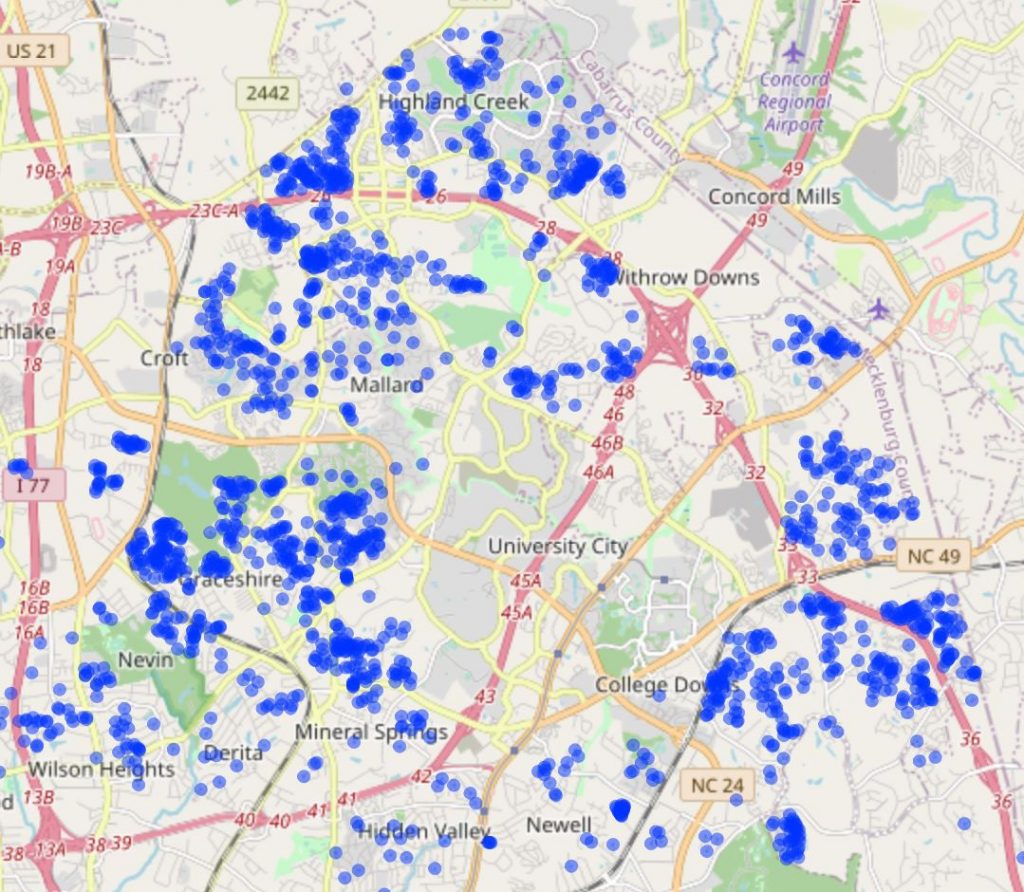

These trends are significant for North Carolina communities because it demonstrates the growing impact financial entities have in shaping where and how people live at the neighborhood-level. This post explores which neighborhoods are most likely to attract buy-to-rent investors using a sample of approximately 8,800 properties owned by four nationally recognized companies: Invitation Homes, Progress Residential, Tricon, and American Homes 4 Rent. Because REITs are often challenging to identify in public tax parcel data, this analysis only looks at activity in Durham, Wake, and Mecklenburg Counties.[1]

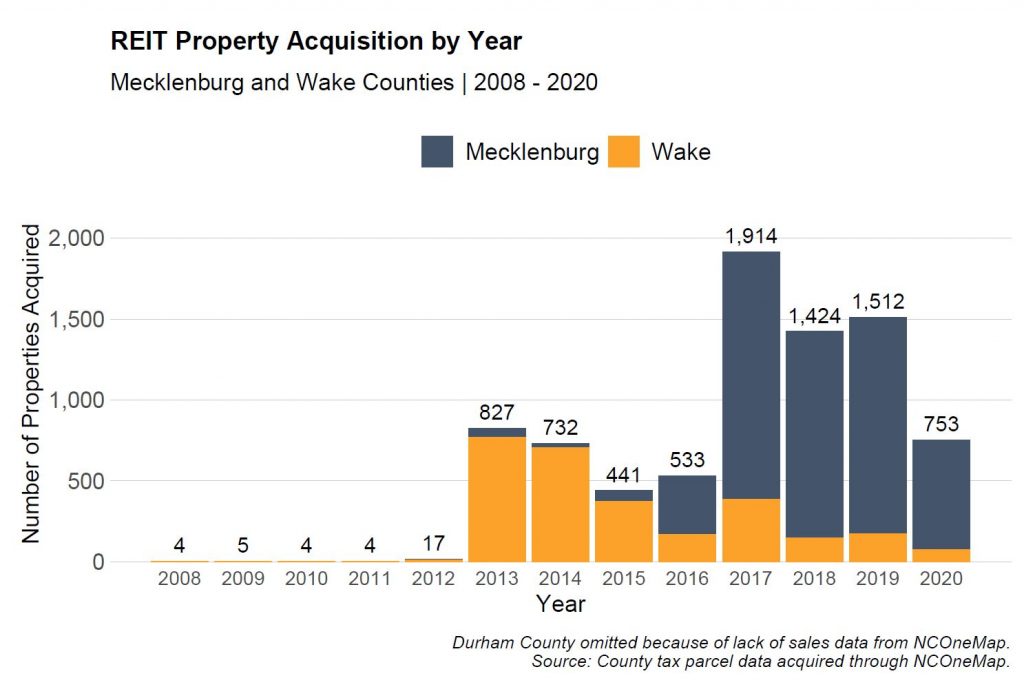

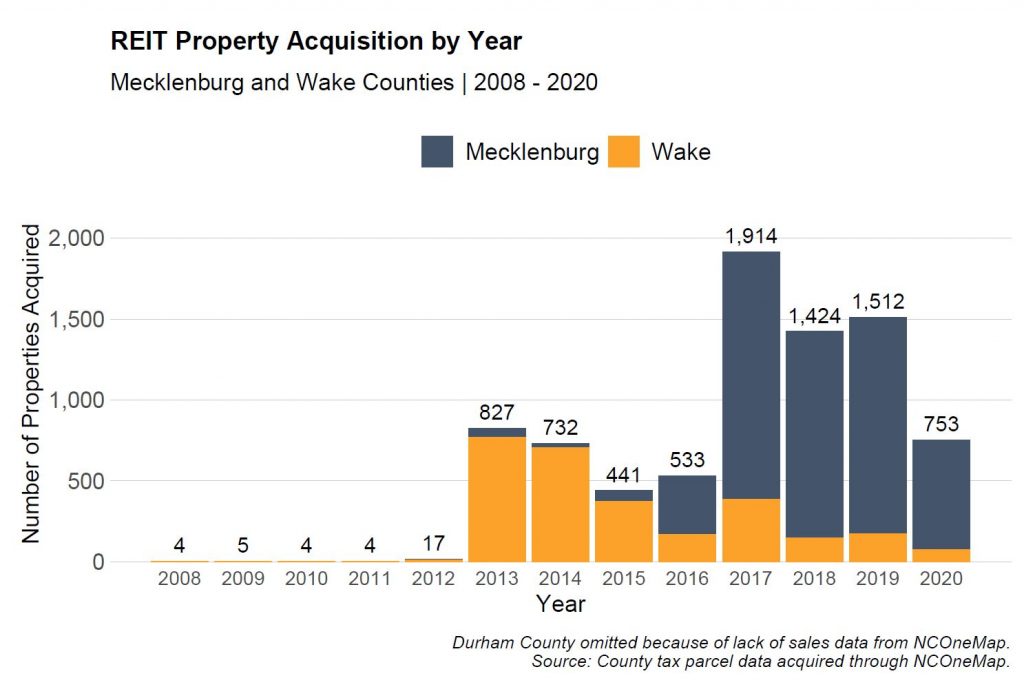

Of the properties identified, 60% were in Mecklenburg County, 36% were in Wake County, and 4% were in Durham. While research on investor activity in other parts of the country show increased investor activity in the early years following the Great Recession, these companies acquired the majority of their properties only in the past few years. Additionally, while acquisitions between 2013 and 2015 were concentrated in the Raleigh region, recent investments shifted to Charlotte.

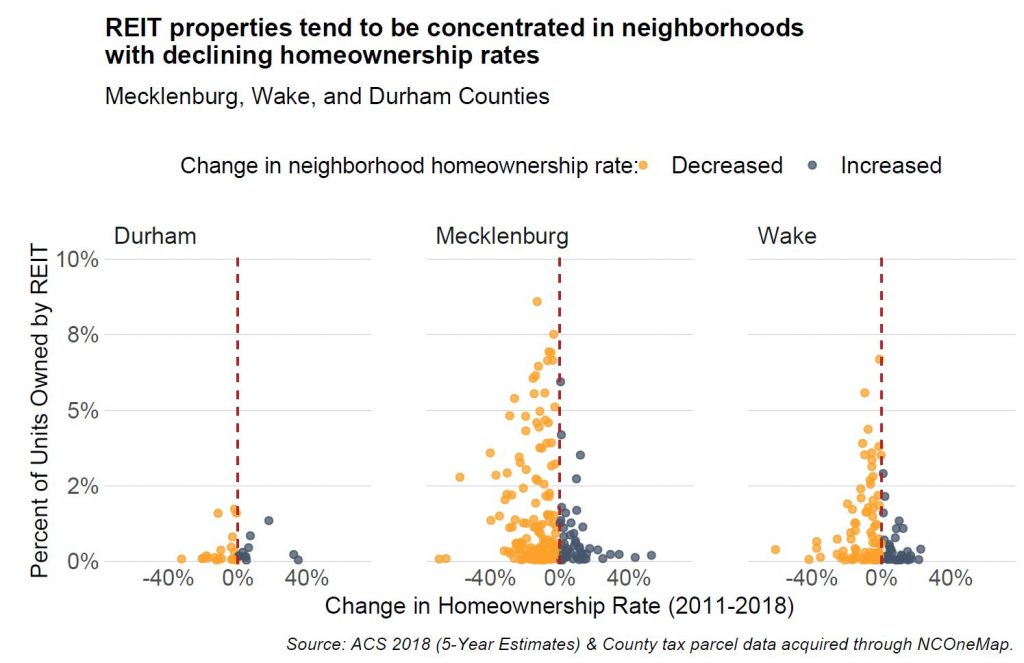

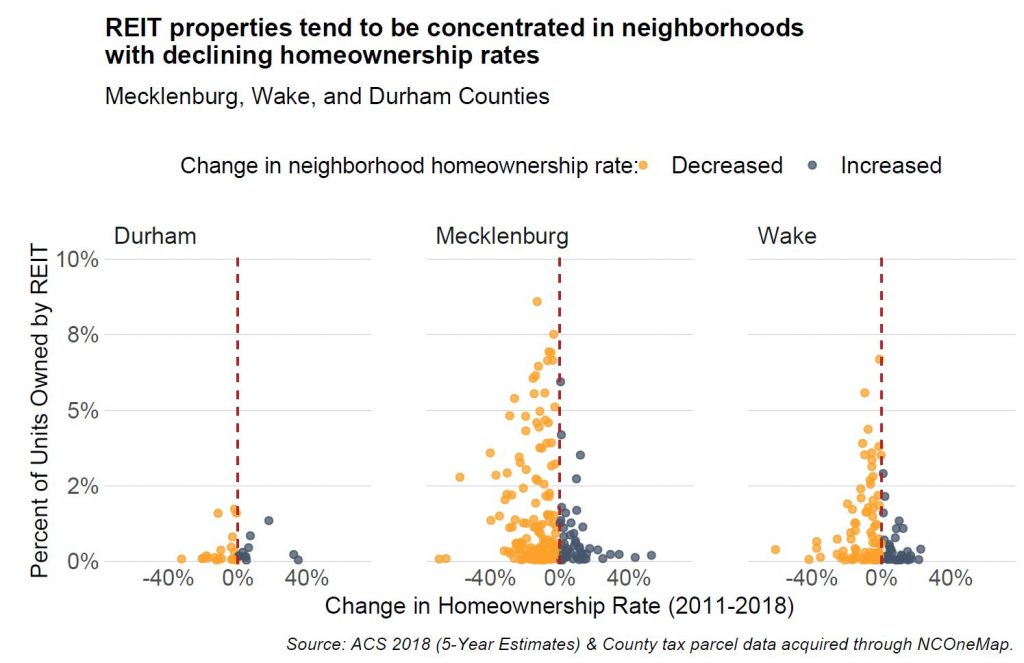

As mentioned above, research shows that buy-to-rent investors were most active in communities with greater concentrations of foreclosed homes. We can use the sample of investor properties to show what kinds of neighborhoods tend to have higher concentrations of investment properties. Figure 2 shows Census Tracts where these investors own properties, with the x-axis showing the change in neighborhood homeownership rate between 2011 and 2018 and y-axis showing the percentage of housing units owned by investors. Of the 119 Census Tracts where REITs own more than one percent of housing units, 100 had declining homeownership rates, suggesting that investors have larger impacts on the supply of rental housing in neighborhoods with already decreasing homeownership rates.

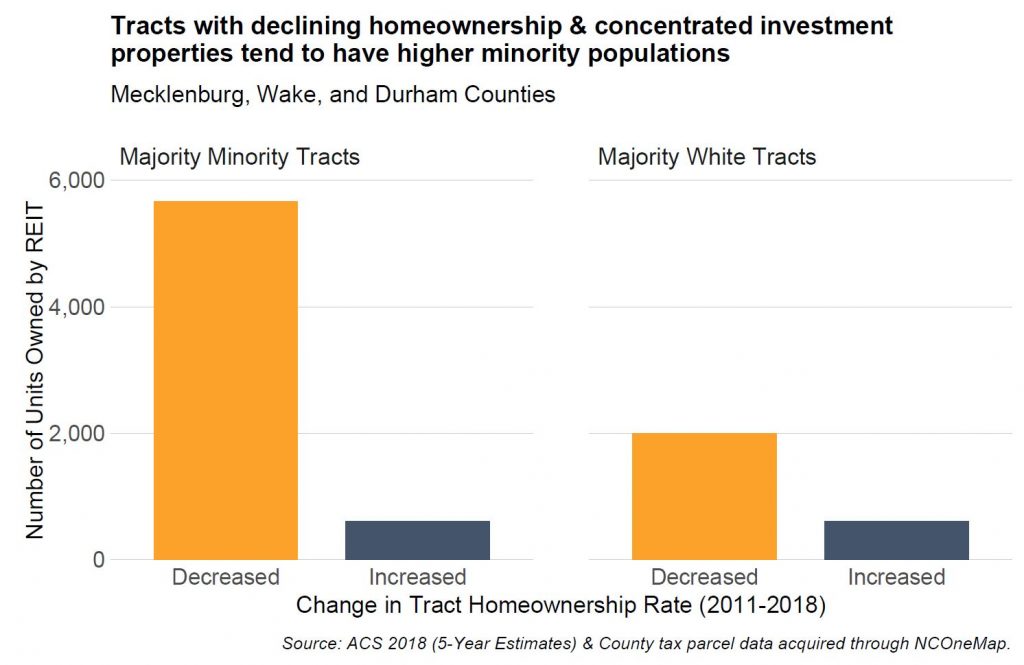

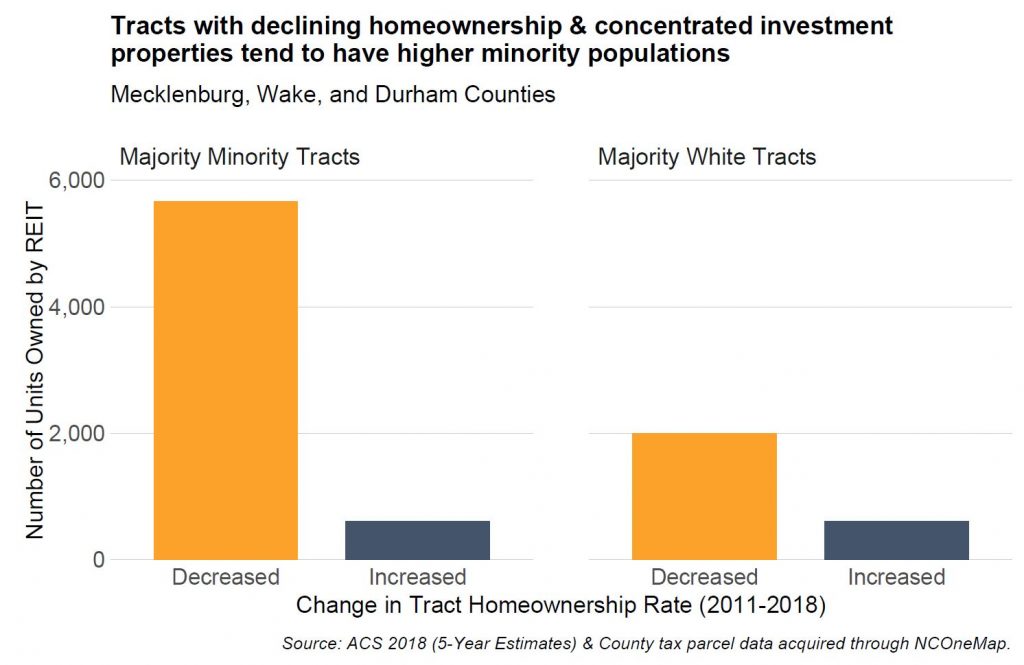

What else do we know about these neighborhoods? Figure 3 shows that nearly 6,000 investor-owned properties are in Census Tracts where homeownership rates have decreased and are predominantly made up of households of color. This is significant because these neighborhoods were also most likely to be made up of Black and Hispanic homeowners who were impacted by the foreclosure crisis. Some news reports in communities such as Atlanta have shown how investors in neighborhoods with declining Black or Hispanic homeownership resort to predatory tactics to acquire properties from homeowners.

These numbers are relevant for North Carolina communities while considering responses to fallout from Covid-19. According to a recent story in the Wall Street Journals, buy-to-rent investors seek to acquire more properties over the next years. While some homes might be acquired following foreclosure, they also express interest in purchasing from cash-poor homeowners who face prolonged unemployment. As home prices have increased over the past, unemployed homeowners unable to pay mortgage payments may be more willing to sell to access needed equity.

“A lot of people are house-rich but cash-poor,” one real-estate consultant told the Wall Street Journal. “If they bought in the last two or three years, even if they bought five months ago, they have equity.”

Buy-to-rent investors have a growing footprint in North Carolina neighborhoods. Tracking these trends is important for understanding how affordable homeownership opportunities are being affected by the growth of single-family rental properties. Finally, prolonged unemployment among low-income homeowners may exacerbate the conversion of affordable single-family homes into rental properties.

[1] Investor-owned properties are often difficult to identify due to the many names under which an investor may own parcels. The properties in this analysis were identified using a combination searches by owner name and mailing addresses for corporate offices. In this sample, the four buy-to-rent investors own property under 215 unique names.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.