|

|

How should we measure North Carolina’s affordable housing crisis?By Frank MuracaPublished April 12, 2021

There are practical benefits to setting housing affordability at 30% of household income. The measurement is easy to calculate and communicate to tenants, developers, and other stakeholders in the affordable housing development process. But there are significant shortcomings as well. The threshold ignores household characteristics that make it more challenging to pay rent in addition to other non-housing expenses. For example, consider two households that each make $30,000 annually. Under the existing affordability standard, each household should pay no more than $750 on housing, with $1,750 leftover for other expenses such as health care, food, or transportation. Each household might have different circumstances that impact these expenses. One household might be made up of one adult and three kids, while another may only have a single working-age adult. For the family of four, their residual income will unlikely cover the additional food, health care, or childcare expenses. Both households live in “affordable” housing according to federal housing policies even if the family of four lacks residual income sufficient to cover other expenses. How should we measure housing affordability to better capture families’ individual economic circumstances? In a 2021 report, researchers at Harvard University’s Joint Center for Housing Studies assessed the 30% income standard and developed a more nuanced methodology for quantifying housing affordability. Rather than focusing exclusively on the cost of housing relative to household income, this affordability measure determines if the residual income leftover after housing costs is sufficient to cover other living expenses such as food, transportation, health care, childcare, and taxes. Let’s look at how this measure can be applied using Wake County as an example. Calculating Residual Income Cost Burden Residual Income Cost Burden relies on two major data sources: household size and age from the U.S. Census and basic household expenditures pulled from the Economic Policy Institute’s (EPI) Family Budget Calculator. The calculator pulls on various data sources to determine how much a family needs to attain a “modest yet adequate standard of living” based on the size of the family and the county where they reside. Cost estimates change based on the composition of the family (up to two adults, and between zero and four children). Because household budgets change dramatically with retirement from access to Medicare and retirement savings, this analysis only includes working-age rental households between 18 and 65. For example, EPI estimates that a household of two adults and two children would need to make $6,457 a month to comfortably cover all non-housing expenses.  Next, we’ll pull from Census microdata to identify household size (including number of children), annual household income, and rent. We’ll merge each working-age household with a monthly budget suggested by EPI based on the number of adults and children (e.g., families without children will have $0 budgeted for childcare). Finally, we’ll subtract rent from their monthly income. If households’ residual income is not sufficient to cover the leftover cost of food, childcare, transportation, health care, taxes, and other necessities, they are considered residual income cost burdened. Let’s compare this measure of affordability with the traditional cost standard by household type. For all working-age renter households, the traditional 30% measure undercounts Raleigh’s affordable housing crisis. Over 90% of working-age single parents lack sufficient incomes to cover both housing costs and other living expenses. Under the traditional affordability threshold, 31% of two-parent households were considered cost burdened. When childcare, food, and health care costs are incorporated under this new methodology, 71% of two-parent renter households face housing affordability challenges.  Residual income cost burden also shows a greater need for affordable housing among middle-income households. Under the new methodology, all rental households making less than $45,000 lack sufficient residual income to cover other living expenses, compared to 79% under the traditional method. But what about middle-income households? Under the 30% threshold, an estimated 4,800 renter households making between $45,000 and $70,000 are cost burdened. Under the new methodology, 14,800 middle-income households lack sufficient income to cover all living expenses.  How can we use this data? It’s clear that the 30% threshold underestimates Raleigh’s affordability crisis. When taking a family’s full budgetary needs into account, an additional 24,000 households struggle to meet housing costs in addition to other necessary expenses. It also highlights how housing cost burdens can disproportionately impact families – especially single parents. Although there are clear benefits to using the 30% threshold when developing housing policies, it is unlikely that it captures the full extent of North Carolina’s affordable housing crisis. Frank Muraca is a Real Estate Development Analyst with the UNC-Chapel Hill School of Government’s Development Finance Initiative.

|

Published April 12, 2021 By Frank Muraca

How much should North Carolina families pay for housing? Affordable housing experts generally agree that housing costs should not exceed 30% of a household’s annual income. This payment standard is applied to nearly every major housing program, including public housing, housing choice vouchers, and properties financed through the Low-Income Housing Tax Credit. In each of these programs, rents are set based on the assumption that they should not exceed 30% of a tenant’s annual income.

How much should North Carolina families pay for housing? Affordable housing experts generally agree that housing costs should not exceed 30% of a household’s annual income. This payment standard is applied to nearly every major housing program, including public housing, housing choice vouchers, and properties financed through the Low-Income Housing Tax Credit. In each of these programs, rents are set based on the assumption that they should not exceed 30% of a tenant’s annual income.

There are practical benefits to setting housing affordability at 30% of household income. The measurement is easy to calculate and communicate to tenants, developers, and other stakeholders in the affordable housing development process. But there are significant shortcomings as well. The threshold ignores household characteristics that make it more challenging to pay rent in addition to other non-housing expenses.

For example, consider two households that each make $30,000 annually. Under the existing affordability standard, each household should pay no more than $750 on housing, with $1,750 leftover for other expenses such as health care, food, or transportation. Each household might have different circumstances that impact these expenses. One household might be made up of one adult and three kids, while another may only have a single working-age adult. For the family of four, their residual income will unlikely cover the additional food, health care, or childcare expenses. Both households live in “affordable” housing according to federal housing policies even if the family of four lacks residual income sufficient to cover other expenses.

How should we measure housing affordability to better capture families’ individual economic circumstances? In a 2021 report, researchers at Harvard University’s Joint Center for Housing Studies assessed the 30% income standard and developed a more nuanced methodology for quantifying housing affordability. Rather than focusing exclusively on the cost of housing relative to household income, this affordability measure determines if the residual income leftover after housing costs is sufficient to cover other living expenses such as food, transportation, health care, childcare, and taxes. Let’s look at how this measure can be applied using Wake County as an example.

Calculating Residual Income Cost Burden

Residual Income Cost Burden relies on two major data sources: household size and age from the U.S. Census and basic household expenditures pulled from the Economic Policy Institute’s (EPI) Family Budget Calculator. The calculator pulls on various data sources to determine how much a family needs to attain a “modest yet adequate standard of living” based on the size of the family and the county where they reside. Cost estimates change based on the composition of the family (up to two adults, and between zero and four children). Because household budgets change dramatically with retirement from access to Medicare and retirement savings, this analysis only includes working-age rental households between 18 and 65.

For example, EPI estimates that a household of two adults and two children would need to make $6,457 a month to comfortably cover all non-housing expenses.

Next, we’ll pull from Census microdata to identify household size (including number of children), annual household income, and rent. We’ll merge each working-age household with a monthly budget suggested by EPI based on the number of adults and children (e.g., families without children will have $0 budgeted for childcare). Finally, we’ll subtract rent from their monthly income. If households’ residual income is not sufficient to cover the leftover cost of food, childcare, transportation, health care, taxes, and other necessities, they are considered residual income cost burdened.

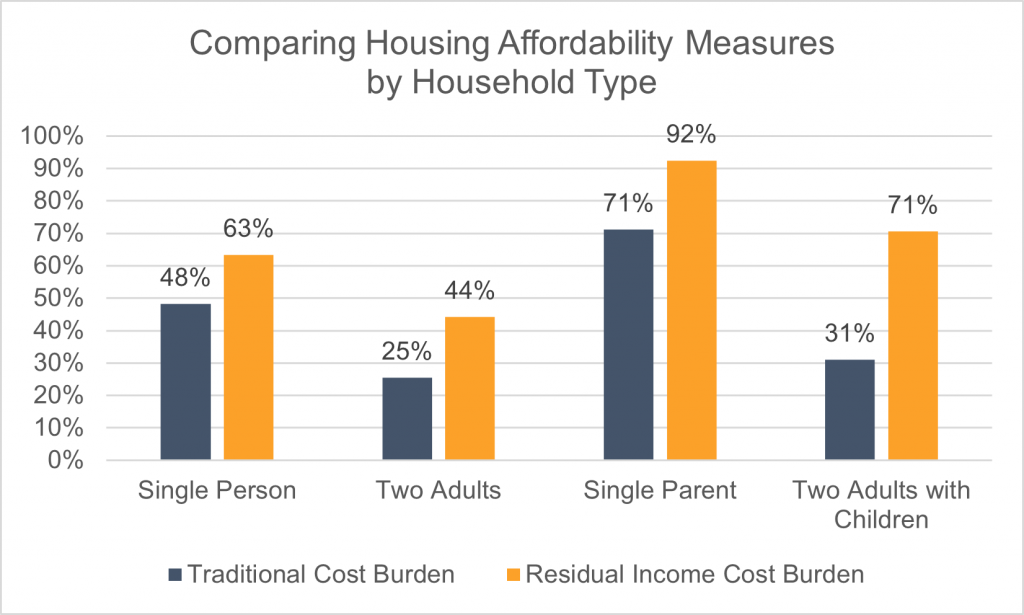

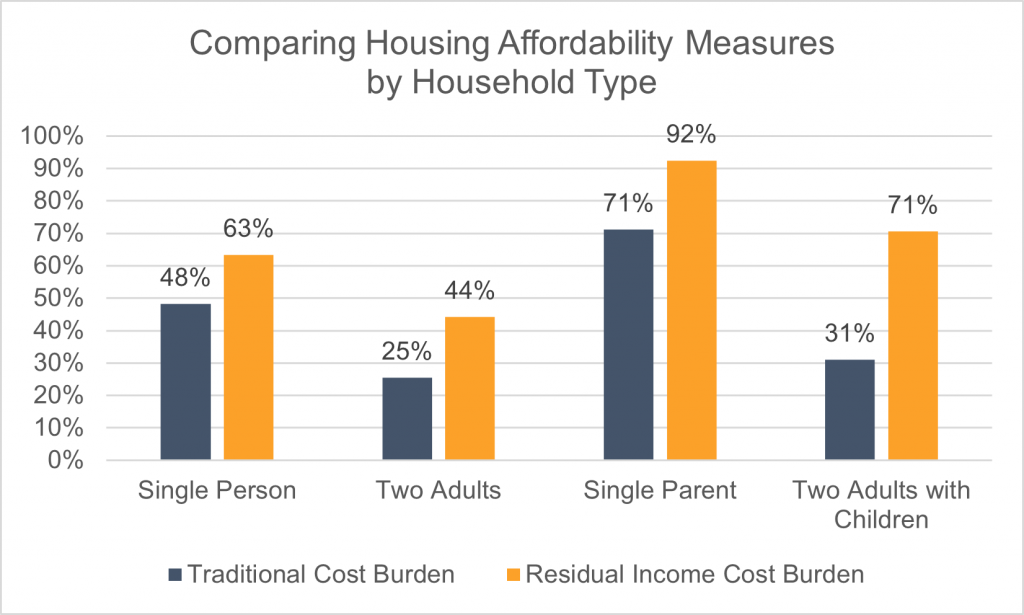

Let’s compare this measure of affordability with the traditional cost standard by household type. For all working-age renter households, the traditional 30% measure undercounts Raleigh’s affordable housing crisis. Over 90% of working-age single parents lack sufficient incomes to cover both housing costs and other living expenses. Under the traditional affordability threshold, 31% of two-parent households were considered cost burdened. When childcare, food, and health care costs are incorporated under this new methodology, 71% of two-parent renter households face housing affordability challenges.

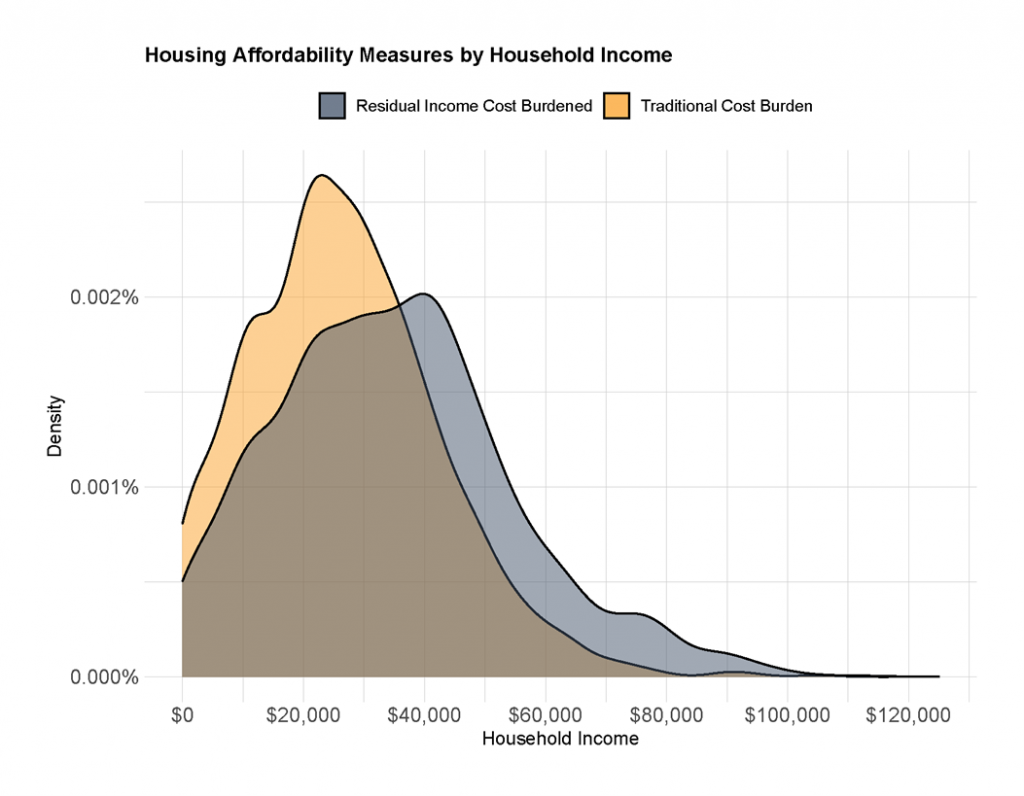

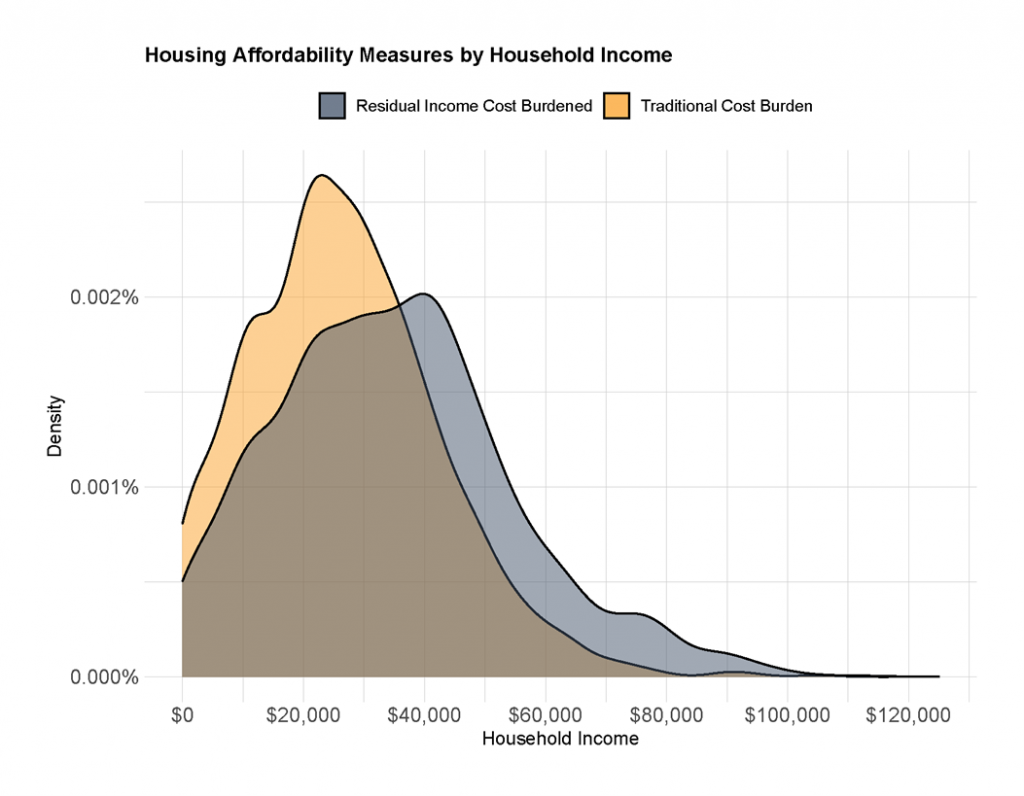

Residual income cost burden also shows a greater need for affordable housing among middle-income households. Under the new methodology, all rental households making less than $45,000 lack sufficient residual income to cover other living expenses, compared to 79% under the traditional method. But what about middle-income households? Under the 30% threshold, an estimated 4,800 renter households making between $45,000 and $70,000 are cost burdened. Under the new methodology, 14,800 middle-income households lack sufficient income to cover all living expenses.

How can we use this data? It’s clear that the 30% threshold underestimates Raleigh’s affordability crisis. When taking a family’s full budgetary needs into account, an additional 24,000 households struggle to meet housing costs in addition to other necessary expenses. It also highlights how housing cost burdens can disproportionately impact families – especially single parents. Although there are clear benefits to using the 30% threshold when developing housing policies, it is unlikely that it captures the full extent of North Carolina’s affordable housing crisis.

Frank Muraca is a Real Estate Development Analyst with the UNC-Chapel Hill School of Government’s Development Finance Initiative.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.