|

|

Student Corner: Property-Assessed Clean Energy (PACE) Programs in North Carolina: Part IBy CED Program Interns & StudentsPublished July 18, 2017

PACE Overview PACE Programs allow state and local governments to facilitate or directly fund fixed energy efficiency or renewable energy installations. These projects are often unattractive because they require high up-front investments that only payoff over time. PACE programs overcome this problem by allowing property owners to make improvements without paying any upfront cash. Local governments can structure PACE financing so it has little or no impact on their balance sheet. PACE programs can also be combined with other clean energy incentives. State governments must pass PACE-enabling legislation before any program can be implemented, which North Carolina did in 2009. Then, state or local governments must establish a PACE financing district before property owners can apply for the program. A PACE program can be either residential (R-PACE) or commercial (C-PACE). North Carolina and twelve other states have PACE legislation, but lack any PACE programs. Nineteen states and D.C. have active PACE programs. C-PACE has financed $322 million in property improvements since 2009, while R-PACE has financed $3.3 billion in improvements. (Note: R-PACE has been a subject of some controversy, which will be addressed in a future blog post. The major points of criticism of the residential PACE program do NOT apply to C-PACE programs.) PACE programs are a new category of special purpose property assessments. Therefore, PACE financing laws are tied to state-specific laws regarding special assessments. (See a UNC School of Government overview of special assessments in North Carolina here). A specific PACE project is often referred to as a “PACE assessment”. In addition to the state-by-state difference in special assessment law, there are several different ways to structure a C-PACE or R-PACE program (which will be addressed in a future post). Nevertheless, all PACE financing follows a basic template. PACE allows residential or commercial property owners to install clean energy improvements without paying any upfront cash. State or local governments provide the necessary funds either directly or through the issuance of a bond. The property owner then repays the loan over 15 to 20 years through a payment attached to their property taxes. This charge would be partially offset by the energy savings as a result of the improvement. Under current law, interest payments on the PACE assessment are also tax deductible. The PACE assessment is tied to the property, not the owner. Thus, if the property is sold, the new owner would be responsible for repaying the PACE assessment. This incentivizes owners to participate in the program even if they are considering selling the property in the next twenty years. It also means that a PACE assessment must be considered when determining the fair market value of a property. In North Carolina, special assessments are backed by a lien on the property, which supersedes mortgages but is junior to the property tax lien. To summarize, the general benefits of PACE financing include:

In theory, these incentives should spur property owners to make investments in energy efficiency and renewable energy, helping encourage economic growth and reduce utility costs. PACE in North Carolina Carol Rosenfeld, an expert at UNC’s School of Government, suggests three reasons why North Carolina has not implemented any PACE financing districts.

If PACE assessments became popular, North Carolina law would incentivize local governments to finance them through revenue bonds. This is because state law “prohibits the payment of the principal of and interest on a revenue bond from any revenue sources except those explicitly pledged to its payment.” Thus, if the revenue from a PACE assessment is insufficient to meet debt service payments, then the local government is not obligated to pay it using other revenue sources. As a result, PACE assessments backed by revenue bonds have a very limited effect on the balance sheet of the local government. General obligation bonds do not have this feature, as the security for these bonds are the “unlimited taxing power of the local government.” Bradley Harris is a Masters student at Duke’s Sanford School of Public Policy as well as an MBA Candidate at the UNC-Chapel Hill Kenan Flagler Business School. Bradley is also currently a Community Revitalization Fellow with the Development Finance Initiative. Sources: https://energy.gov/sites/prod/files/2014/06/f16/ch12_commercial_pace_all.pdf https://energy.gov/sites/prod/files/2014/01/f7/commercial_pace_primer.pdf http://www.sogpubs.unc.edu/electronicversions/pdfs/lfb40.pdf http://efc.web.unc.edu/2015/10/16/pace-nc/ http://www.nrel.gov/docs/fy10osti/47097.pdf http://pacenation.us/pace-market-data/ https://sallan.org/pdf-docs/PACE_CommBldgs.pdf https://efc.sog.unc.edu/sites/www.efc.sog.unc.edu/files/PACE%20Aug%2013%20Update.pdf |

Published July 18, 2017 By CED Program Interns & Students

There are several ways for state and local leaders to promote investments in their communities and reduce utility costs for residents. One tool that has been often overlooked in North Carolina are Property-Assessed Clean Energy (PACE) programs. This post provides an overview of PACE programs and their history in North Carolina. A subsequent post will examine the benefits and drawbacks of PACE financing in more detail.

There are several ways for state and local leaders to promote investments in their communities and reduce utility costs for residents. One tool that has been often overlooked in North Carolina are Property-Assessed Clean Energy (PACE) programs. This post provides an overview of PACE programs and their history in North Carolina. A subsequent post will examine the benefits and drawbacks of PACE financing in more detail.

PACE Overview

PACE Programs allow state and local governments to facilitate or directly fund fixed energy efficiency or renewable energy installations. These projects are often unattractive because they require high up-front investments that only payoff over time. PACE programs overcome this problem by allowing property owners to make improvements without paying any upfront cash. Local governments can structure PACE financing so it has little or no impact on their balance sheet. PACE programs can also be combined with other clean energy incentives.

State governments must pass PACE-enabling legislation before any program can be implemented, which North Carolina did in 2009. Then, state or local governments must establish a PACE financing district before property owners can apply for the program. A PACE program can be either residential (R-PACE) or commercial (C-PACE). North Carolina and twelve other states have PACE legislation, but lack any PACE programs. Nineteen states and D.C. have active PACE programs. C-PACE has financed $322 million in property improvements since 2009, while R-PACE has financed $3.3 billion in improvements. (Note: R-PACE has been a subject of some controversy, which will be addressed in a future blog post. The major points of criticism of the residential PACE program do NOT apply to C-PACE programs.)

PACE programs are a new category of special purpose property assessments. Therefore, PACE financing laws are tied to state-specific laws regarding special assessments. (See a UNC School of Government overview of special assessments in North Carolina here). A specific PACE project is often referred to as a “PACE assessment”.

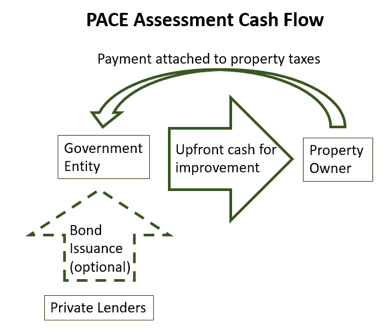

In addition to the state-by-state difference in special assessment law, there are several different ways to structure a C-PACE or R-PACE program (which will be addressed in a future post). Nevertheless, all PACE financing follows a basic template.

PACE allows residential or commercial property owners to install clean energy improvements without paying any upfront cash. State or local governments provide the necessary funds either directly or through the issuance of a bond. The property owner then repays the loan over 15 to 20 years through a payment attached to their property taxes. This charge would be partially offset by the energy savings as a result of the improvement. Under current law, interest payments on the PACE assessment are also tax deductible.

The PACE assessment is tied to the property, not the owner. Thus, if the property is sold, the new owner would be responsible for repaying the PACE assessment. This incentivizes owners to participate in the program even if they are considering selling the property in the next twenty years. It also means that a PACE assessment must be considered when determining the fair market value of a property. In North Carolina, special assessments are backed by a lien on the property, which supersedes mortgages but is junior to the property tax lien.

To summarize, the general benefits of PACE financing include:

- Encourages property owners to invest in renewable energy or energy efficiency improvements without paying any upfront cash, even if they plan on selling in the next few years.

- Allows property owners to benefit from energy savings and tax deductions on interest charges immediately, which can help offset repayments.

- By attaching repayments to property taxes, is it simple for property owners to repay.

In theory, these incentives should spur property owners to make investments in energy efficiency and renewable energy, helping encourage economic growth and reduce utility costs.

PACE in North Carolina

Carol Rosenfeld, an expert at UNC’s School of Government, suggests three reasons why North Carolina has not implemented any PACE financing districts.

- Local governments in North Carolina are unfamiliar with special assessments as a public finance tool.

- In North Carolina, only municipalities or counties have the authority to place the liens and issue the debt necessary to create PACE Assessments. Some other states have state-level entities that can create PACE assessments. This allows the program to be standardized, benefit from economies of scale, and reduces the administrative burden for local governments to participate. Considering the complexity and resources involved in creating a new C-PACE program, it would likely only be beneficial for large counties in North Carolina.

- Any PACE Assessment would require State-level approval. North Carolina’s Local Government Commission must approve all debt issued by local governments. Therefore, any PACE-backed bonds would require this approval.

If PACE assessments became popular, North Carolina law would incentivize local governments to finance them through revenue bonds. This is because state law “prohibits the payment of the principal of and interest on a revenue bond from any revenue sources except those explicitly pledged to its payment.” Thus, if the revenue from a PACE assessment is insufficient to meet debt service payments, then the local government is not obligated to pay it using other revenue sources. As a result, PACE assessments backed by revenue bonds have a very limited effect on the balance sheet of the local government. General obligation bonds do not have this feature, as the security for these bonds are the “unlimited taxing power of the local government.”

Bradley Harris is a Masters student at Duke’s Sanford School of Public Policy as well as an MBA Candidate at the UNC-Chapel Hill Kenan Flagler Business School. Bradley is also currently a Community Revitalization Fellow with the Development Finance Initiative.

Sources:

https://energy.gov/sites/prod/files/2014/06/f16/ch12_commercial_pace_all.pdf

https://energy.gov/sites/prod/files/2014/01/f7/commercial_pace_primer.pdf

http://www.sogpubs.unc.edu/electronicversions/pdfs/lfb40.pdf

http://efc.web.unc.edu/2015/10/16/pace-nc/

http://www.nrel.gov/docs/fy10osti/47097.pdf

http://pacenation.us/pace-market-data/

https://sallan.org/pdf-docs/PACE_CommBldgs.pdf

https://efc.sog.unc.edu/sites/www.efc.sog.unc.edu/files/PACE%20Aug%2013%20Update.pdf

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.