|

|

Student Corner: North Carolina’s Opportunity Zones CertifiedBy CED Program Interns & StudentsPublished July 5, 2018

The Opportunity Zone (OZ) program was created as a part of the federal Tax Cuts and Jobs Act of 2017. An overview of the program previously posted on the CED blog can be found here. On May 18, 2018 the US Secretary of Treasury certified 252 census tracts in North Carolina as OZs. The designation of OZs allows investors to gain tax benefits through investment in business activities – including real estate – in the certified zones. North Carolina’s OZ nomination process was guided by the North Carolina Department of Commerce using quantitative data and input from local communities. This blog post will provide a brief overview of the designated OZs. Future posts will discuss specific zones and potential development strategies for communities to take advantage of their local Zone designations. Opportunity Zone qualifications were based on American Community Survey (ACS) 2015 5-Year data, so all analysis in this post uses ACS 2015 5-Year where applicable. Qualified Tracts To be eligible for OZ designation, a census tract must be a low-income tract under the New Markets Tax Credit criteria or through the Contiguous Tract rule created by the OZ program. The Contiguous Tract rule allows for non-low-income census tracts to be designated as an OZ as long as the tract’s median family income “does not exceed 125 percent of the low-income community with which the tract is contiguous” (Sec. 1400Z). Up to five percent of a state’s OZs can be designated through the Contiguous Tract rule. The Contiguous Tract rule allows states to take a district approach if there are bands of low-income tracts with a non-low-income tract in-between. This approach was taken in Edgecombe, Lenoir and Wilkes counties to tie together bands of OZs. In other parts of the state the Contiguous Tract rule extends OZs to cover more area in a community. In total, North Carolina designated eleven OZs using the Contiguous Tract rule. Zone Selection According to Napoleon Wallace, Deputy Secretary NC Department of Commerce for Rural Economic Development and Workforce Solutions, zone selections were based on a variety of priorities including need and geographic equity. Other OZ designation principles included prioritization of North Carolina’s Economic Development “Megasites”, areas affected by Hurricane Matthew, and feedback from local communities. Forty six percent (1,007 of 2,195) of North Carolina’s census tracts are considered low-income and would qualify for OZ status. One factor North Carolina prioritized during the zone designation process was designating at least one OZ in each of the state’s 100 counties. Only two of North Carolina’s counties do not have a low-income census tract – Polk and Camden – and those counties received OZs using the Contiguous Tract rule. South Carolina and Alabama followed a similar selection approach designating at least one OZ in each county. In contrast, Georgia only designated OZs in 79 of their 159 counties and Tennessee only designated OZs in 75 of 95 counties. Of NC’s 252 Opportunity Zones, 155 are located in urban areas and the other 97 are in rural areas as defined by the Census Bureau. Fifty-three counties received only one Opportunity Zone and thirty-one of those counties are designated as tier-one counties(the state’s most economically distressed counties, according to the Department of Commerce). This designation pattern suggests a tendency to nominate districts in generally more urban areas of the state, which reflects NC’s concentration of population in urban areas. But with at least one Opportunity Zone in each of the state’s 100 counties, even the state’s most rural areas will be able to benefit from the OZ program. Demographic Comparison North Carolina selected tracts that have higher unemployment and lower household income then the state’s OZ-eligible tracts as a whole. This seems to indicate that North Carolina’s OZs are among the highest-need parts of the state.  Counties with the most Opportunity Zones  Summary NC’s priority of geographically equitable OZ designation may encourage private investment in a wider range of communities than are currently attracting capital. Cities and towns with OZs stand to leverage this tool to meet their community development goals, but at this early stage it remains to be seen exactly how OZs will be activated. Future posts will take a closer look at particular OZs and discuss strategies local governments can apply to achieve community development goals through Opportunity Zones. For more about how NC local governments can take advantage of their Opportunity Zones, see Tyler Mulligan’s post, Federal Opportunity Zones: What Local Governments Need to Know, and visit DFI’s Opportunity Zone Resource Page. Bobby Funk is a Master’s candidate at UNC-Chapel Hill’s Department of City and Regional Planning and a Community Revitalization Fellow with the Development Finance Initiative. |

Published July 5, 2018 By CED Program Interns & Students

The Opportunity Zone (OZ) program was created as a part of the federal Tax Cuts and Jobs Act of 2017. An overview of the program previously posted on the CED blog can be found here. On May 18, 2018 the US Secretary of Treasury certified 252 census tracts in North Carolina as OZs. The designation of OZs allows investors to gain tax benefits through investment in business activities – including real estate – in the certified zones. North Carolina’s OZ nomination process was guided by the North Carolina Department of Commerce using quantitative data and input from local communities. This blog post will provide a brief overview of the designated OZs. Future posts will discuss specific zones and potential development strategies for communities to take advantage of their local Zone designations.

Opportunity Zone qualifications were based on American Community Survey (ACS) 2015 5-Year data, so all analysis in this post uses ACS 2015 5-Year where applicable.

Qualified Tracts

To be eligible for OZ designation, a census tract must be a low-income tract under the New Markets Tax Credit criteria or through the Contiguous Tract rule created by the OZ program. The Contiguous Tract rule allows for non-low-income census tracts to be designated as an OZ as long as the tract’s median family income “does not exceed 125 percent of the low-income community with which the tract is contiguous” (Sec. 1400Z). Up to five percent of a state’s OZs can be designated through the Contiguous Tract rule. The Contiguous Tract rule allows states to take a district approach if there are bands of low-income tracts with a non-low-income tract in-between. This approach was taken in Edgecombe, Lenoir and Wilkes counties to tie together bands of OZs. In other parts of the state the Contiguous Tract rule extends OZs to cover more area in a community. In total, North Carolina designated eleven OZs using the Contiguous Tract rule.

Zone Selection

According to Napoleon Wallace, Deputy Secretary NC Department of Commerce for Rural Economic Development and Workforce Solutions, zone selections were based on a variety of priorities including need and geographic equity. Other OZ designation principles included prioritization of North Carolina’s Economic Development “Megasites”, areas affected by Hurricane Matthew, and feedback from local communities.

Forty six percent (1,007 of 2,195) of North Carolina’s census tracts are considered low-income and would qualify for OZ status. One factor North Carolina prioritized during the zone designation process was designating at least one OZ in each of the state’s 100 counties. Only two of North Carolina’s counties do not have a low-income census tract – Polk and Camden – and those counties received OZs using the Contiguous Tract rule. South Carolina and Alabama followed a similar selection approach designating at least one OZ in each county. In contrast, Georgia only designated OZs in 79 of their 159 counties and Tennessee only designated OZs in 75 of 95 counties.

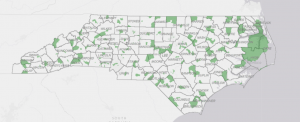

Of NC’s 252 Opportunity Zones, 155 are located in urban areas and the other 97 are in rural areas as defined by the Census Bureau. Fifty-three counties received only one Opportunity Zone and thirty-one of those counties are designated as tier-one counties(the state’s most economically distressed counties, according to the Department of Commerce). This designation pattern suggests a tendency to nominate districts in generally more urban areas of the state, which reflects NC’s concentration of population in urban areas. But with at least one Opportunity Zone in each of the state’s 100 counties, even the state’s most rural areas will be able to benefit from the OZ program.

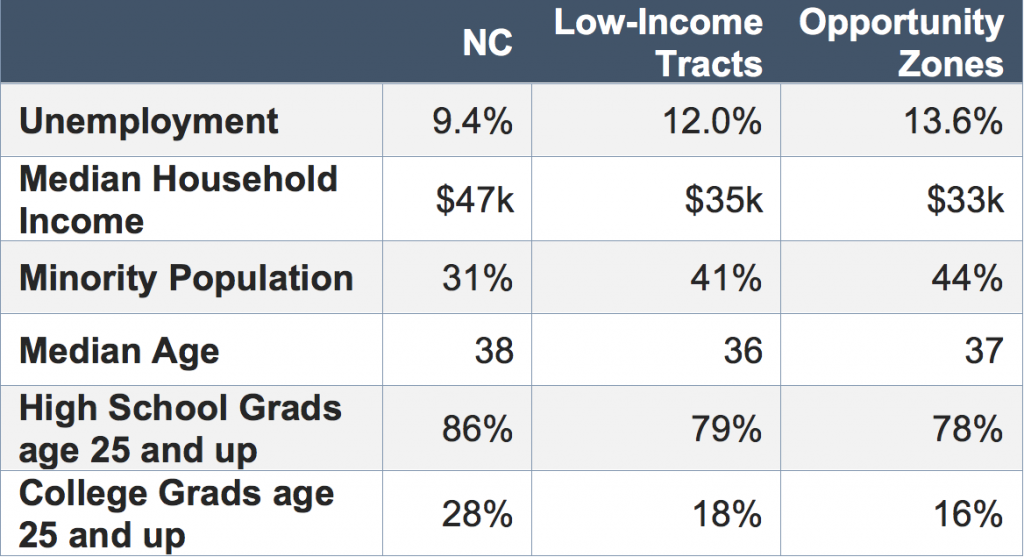

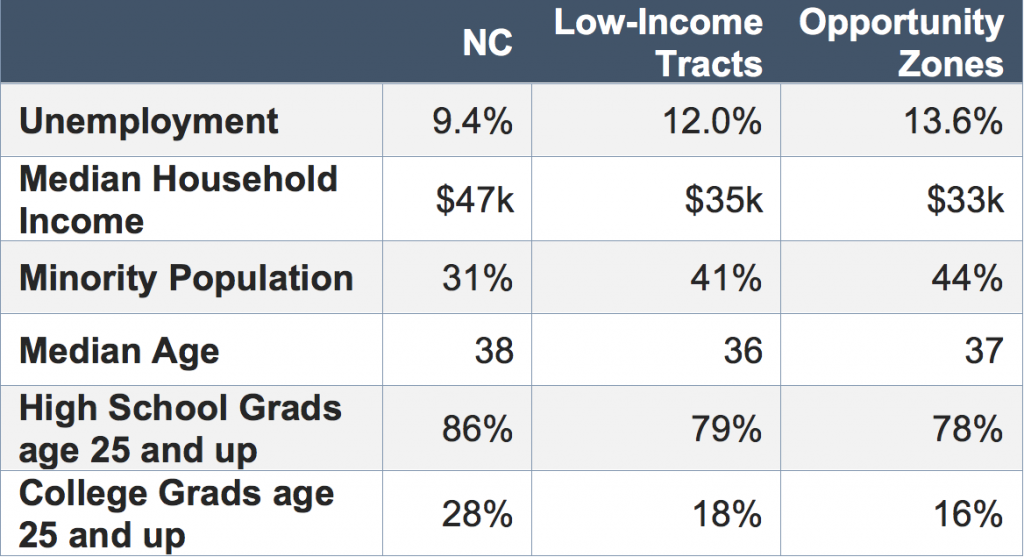

Demographic Comparison

North Carolina selected tracts that have higher unemployment and lower household income then the state’s OZ-eligible tracts as a whole. This seems to indicate that North Carolina’s OZs are among the highest-need parts of the state.

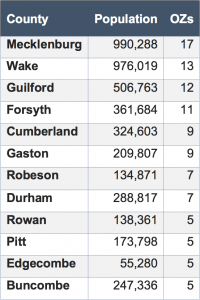

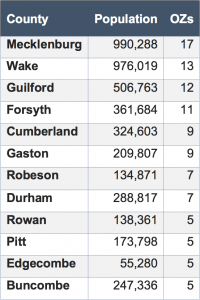

Counties with the most Opportunity Zones

Summary

NC’s priority of geographically equitable OZ designation may encourage private investment in a wider range of communities than are currently attracting capital. Cities and towns with OZs stand to leverage this tool to meet their community development goals, but at this early stage it remains to be seen exactly how OZs will be activated. Future posts will take a closer look at particular OZs and discuss strategies local governments can apply to achieve community development goals through Opportunity Zones. For more about how NC local governments can take advantage of their Opportunity Zones, see Tyler Mulligan’s post, Federal Opportunity Zones: What Local Governments Need to Know, and visit DFI’s Opportunity Zone Resource Page.

Bobby Funk is a Master’s candidate at UNC-Chapel Hill’s Department of City and Regional Planning and a Community Revitalization Fellow with the Development Finance Initiative.

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.